Estamos experimentando una alta demanda. Volveremos a la normalidad pronto. Gracias por su paciencia.

Compartir

Liquidado por el promotor

Nueces de macadamia.

Mount Kenya, KE

pagos

semestral

plazo

6 meses

interés anual

4.5%

rating riesgo

B+

Capital circulante para los pequeños productores de nueces.

Descripción

Working Capital Associates es una empresa que financia cadenas de valor agrícolas en África Subsahariana y América Latina. Hasta la fecha, la empresa ha recaudado 1.770.000€ a través de Goparity para financiar varias organizaciones: una cooperativa de café en Perú (Agricultura Peruana Resiliente, II y III); una empresa de cacao en Perú que agrupa pequeños productores (Cacau Orgânico do Peru, II, III y IV ); y una empresa familiar de cacao en Ecuador (Cacau do Equador, II, III, IV, V, VI e VII).

Esta es la decimoquinta campaña de WCA con GoParity. Diez de las catorce campañas anteriores ya han alcanzado con éxito el vencimiento de su plan de pagos. Todos los inversionistas recibieron su capital invertido (un total de 1.290.000€ prestados) y los intereses correspondientes.

El objetivo de esta campaña es financiar una empresa familiar con sede en Kenia: Privamnuts, activa en el procesamiento y exportación de nueces de macadamia.

Las nueces de macadamia son nueces de sabor mantecoso que crecen en árboles de macadamia, una especie nativa de Australia. Con un alto valor nutritivo y beneficios dietéticos, estas nueces son un ingrediente popular en snacks, panadería y artículos de confitería. Otras aplicaciones incluyen cosméticos, bebidas y aceites alimentarios (que pueden ser utilizados para cocinar o aliñar, entre otros).

Privamnuts compra las nueces de macadamia no procesadas a pequeños agricultores, las procesa en su fábrica y las exporta principalmente a los mercados de América y Europa. La empresa posee la certificación del sistema de seguridad alimentaria FSSC 22000 (una importante certificación en el sistema de gestión de seguridad alimentaria), que permite a una organización demostrar su capacidad de proporcionar productos seguros y de calidad que cumplan con los requisitos del cliente y las normativas aplicables. La empresa también tiene certificaciones Halal y Kosher.

Sus nueces de macadamia se cultivan en los suelos montañosos ricos en minerales del Monte Kenia, en la línea ecuatorial, donde trabajan más de ochenta mil pequeños agricultores. La empresa depende exclusivamente de pequeños agricultores para el suministro de nueces. Más de 10.000 están trabajando con la empresa y aproximadamente el 65% son mujeres. La recolección de nueces crudas se realiza a través de 150 centros de compra, que son gestionados por supervisores de campo.

Según la empresa, los agricultores permiten que sus árboles crezcan naturalmente con poca intervención, utilizando los recursos naturales disponibles como estiércol animal, sin pulverización. La empresa se enorgullece de las relaciones construidas con los agricultores y proporciona servicios de valor agregado, como formación (desde mejores prácticas agrícolas hasta cuidado post-cosecha y alfabetización financiera) y materias primas (como un vivero con más de 100.000 plántulas de macadamia disponibles para los agricultores a precios subsidiados para garantizar que todos tengan acceso a semillas y plantas de calidad).

La empresa tiene una política de compra directa, que asegura que los agricultores reciban casi el doble de lo que recibirían si vendieran en otros mercados. Debido a la acción de la empresa en la región, cada vez más agricultores están interesados en diversificar sus cultivos para incluir nueces de macadamia.

La empresa ha implementado sistemas de control de calidad a lo largo de toda la cadena de valor. El equipo de control de calidad es auditado por el equipo de garantía de calidad, asegurando el control de calidad desde la explotación agrícola hasta el punto de venta (los controladores participan en la recolección de las nueces y realizan verificaciones por muestreo de las nueces traídas por los agricultores para asegurarse de que cumplan con los criterios). La trazabilidad completa de cada lote de frutos secos y los controles de calidad después de cada etapa del procesamiento aseguran que el producto enviado a los clientes cumpla con sus especificaciones técnicas.

La empresa tiene actualmente una capacidad de procesamiento de 7.000 toneladas métricas de frutos secos por año. Esto equivale a aproximadamente 1.050 toneladas métricas de productos exportables, dada una tasa de recuperación del 15%. El proceso de producción involucra el secado de las nueces y la reducción de la humedad.

La fábrica tiene energía garantizada por Kenya Power and Lighting Co., que tiene paneles solares suficientes para garantizar el consumo durante las interrupciones de energía, sin embargo, aún se necesita un generador para el consumo intensivo de energía necesario en el proceso de descascarado. El plan a largo plazo es aumentar la capacidad solar.

Actualmente, Kenia es el tercer mayor productor de macadamia en el mundo, después de Australia y Sudáfrica. La cuota de mercado de Kenia aumentó del 7,2% en 2009 al 12,2% en 2018. Kenia también registró el mayor crecimiento en los volúmenes de producción durante el período mencionado. La producción de macadamia de Kenia creció significativamente durante la última década, pasando de 11.000 toneladas métricas de "nueces con cáscara" (NCC) en 2009 a 42.500 toneladas en 2018. La mayor parte de la macadamia de Kenia es producida por unos 200.000 pequeños agricultores.

Desde la década de 1970 hasta la actualidad, la industria de la macadamia ha crecido rápidamente, alcanzando una producción global de 230.000 toneladas métricas (MT) con cáscara y 60.000 de nuez (con un 3,5% de humedad en nueces con cáscara) en 2019. La producción global de nueces de macadamia se duplicó durante la última década, pasando de aproximadamente 30.000 toneladas métricas en 2010 a unas 60.000 toneladas métricas en 2020.

La Autoridad Agrícola y Alimentaria de Kenia (AFA) estima que, con un aumento en el área cultivada, la producción alcanzará las 60.000 toneladas de NCC en 2022. Esto representaría un aumento de alrededor del 50% en comparación con 2019.

Se espera que la producción global aumente a más de 440.000 toneladas de NCC para 2025 y más de 680.000 toneladas en los próximos diez años, en comparación con las aproximadamente 22.000 toneladas de NCC producidas actualmente. La producción se ha duplicado en los últimos 10 años y se prevé que la tasa de crecimiento de la producción de macadamia en los próximos diez años sea aún más significativa que en la última década, es decir, se duplicará en los próximos 5 años y se triplicará en los próximos 10 años.

El gobierno de Kenia tiene la intención de que todas las nueces de macadamia cultivadas en el país se procesen localmente, ya que esto empoderaría a los procesadores locales, aumentaría el valor agregado interno, garantizaría más empleos y aumentaría los ingresos de los agricultores. Como resultado, la capacidad de procesamiento ya ha aumentado de 4 procesadores en 2009 a al menos 30 procesadores en 2018. Se prevé que los procesadores aumenten la capacidad de procesamiento instalada a aproximadamente 90.000 toneladas de NCC en los próximos años. Aún hay mucho espacio para expandir el procesamiento, al menos el 50% de la capacidad que actualmente no se utiliza.

El impacto

Directo

- Mejora de la estabilidad financiera de pequeños agricultores: Al vender directamente a la empresa transformadora, los pequeños agricultores tienen acceso a mejores condiciones financieras y un mayor margen de ganancia por sus productos. Las campañas de Nueces de macadamia en total tienen un impacto en un grupo de 80.000 agricultores, y esta campaña sola mejora las condiciones financieras de 20.000 pequeños agricultores.

Indirecto

- Promoción de la producción alimentaria orgánica y de calidad: la empresa posee la certificación de seguridad alimentaria más alta, la FSSC 22000. Además, la producción de nueces de macadamia se realiza mediante el crecimiento de los árboles con poca intervención y el uso de recursos naturales. Asimismo, la empresa tiene su propio vivero de nueces de macadamia para proporcionar a los agricultores más de 100.000 plantones que permiten una producción orgánica desde el vivero hasta las explotaciones.

- Promoción de energía limpia y descarbonización de la industria: la instalación de procesamiento está alimentada por energía solar en caso de corte de electricidad en la red, y el plan es aumentar la capacidad de producción de energía solar.

- Promoción de la economía de Kenia: el procesamiento de frutos secos que ocurre en Kenia permite agregar valor doméstico y aumentar la creación de empleos e ingresos.

- Promoción de las políticas de responsabilidad social de la empresa: los agricultores reciben formación técnica sobre métodos de producción, y apoyan clubes y sociedades locales.

Impact Indicators

5.000

Personas impactadas

Contribución a los Objetivos

de Desarrollo Sostenible

Objetivos de Desarrollo Sostenible

.359d24f.png)

.9237116.png)

Viabilidad Financiera

Los fondos recaudados a través de esta campaña se utilizarán como capital para proporcionar liquidez a la empresa desde su fase de adquisición y procesamiento hasta sus exportaciones.

El capital circulante tiene las siguientes ventajas:

- Liquidez para la compra de materia prima: el productor tendrá la capacidad para comprar materia prima para satisfacer nuevos pedidos de compra, sin tener que esperar el pago de los compradores actuales, lo que le permitirá hacer crecer su negocio.

- Precios más altos: al eliminar la presión de la liquidez, los productores ya no estarán obligados a ofrecer descuentos a los compradores a cambio de un pago anticipado, recibiendo un precio más alto por el cacao certificado, que refleja su valor real.

- Mayor margen de ganancia que puede ser reinvertido: con un margen de ganancia más alto, este dinero garantiza no solo la estabilidad financiera de los productores, sino que también puede ser utilizado para invertir en formación y capacitación, así como en los costos de certificación de producción orgánica y comercio justo.

La WCA tiene un Seguro de Crédito Comercial otorgado por una aseguradora global que opera en más de 50 países. El pago está garantizado por esta póliza, que protege a los inversionistas de GoParity en caso de incumplimiento (por ejemplo, insolvencia). Las coberturas de la póliza incluyen pérdidas en caso de insolvencia, morosidad prolongada y riesgo político hasta el 90% del valor de la transacción comercial financiada por WCA. Dado que WCA proporciona un máximo del 80% de financiamiento para cualquier transacción, la póliza en su esencia cubre más que el financiamiento global de WCA.

Download Información Financiera para el Inversor de Financiación Colaborativa (IFIFC)

El Promotor

Sobre WCA (Working Capital Associates) LLP

Working Capital Associates (WCA) se fundó en 2018 por Federica Sambiase – profesional senior del sector financiero y bancario – y CEO de la empresa. Experimentó de primera mano como los bancos comerciales tradicionales no conseguían adaptarse a las necesidades de los prestatarios de PYMES y sus requisitos hechos a medida, especialmente en regiones como SSA y Latam, donde la necesidad de crédito crecía rápidamente.

La visión de WCA refleja más de 20 años de experiencia de su líder en el mundo de las finanzas, así como la pasión por el desarrollo e igualdad de género, madurada y nutrida durante sus años como miembro de la junta directiva de la ONG Care International.

WCA es la única empresa – liderada por mujeres y cuya propiedad es totalmente femenina- que proporciona financiación directa a la cadena de valor de productos agrícolas en África subsahariana (SSA) y Latinoamérica (Latam).

WCA está comprometida con un enfoque de negocio profesional, ético y transparente, efectuando inversiones socialmente responsables “que permiten a los inversores abordar los criterios medioambientales, sociales y de gobernanza empresarial (ASG) mediante la inversión en soluciones específicas, como por ejemplo la energía renovable, gestión de residuos y agua, silvicultura y agricultura, productos de salud e inclusión financiera ” (PRI).

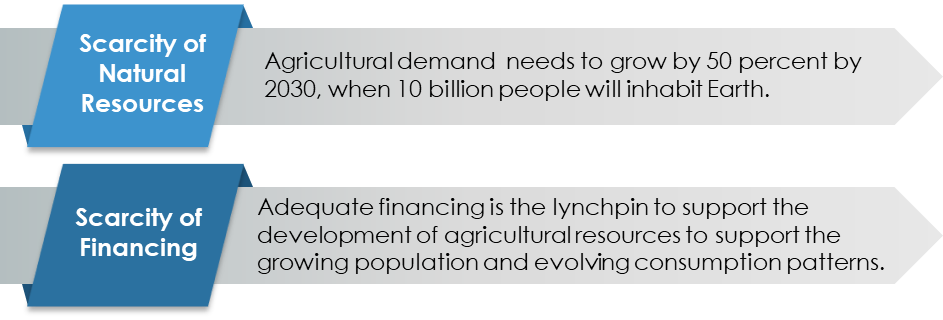

La empresa sigue dos cuestiones clave:

La empresa también aplica inversión en lentes de género, procurando financiar un nivel significativo de negocios liderados por mujeres que siguen los estándares de gestión sostenible y responsable.

El propósito de WCA es aumentar la cadena de valor proporcionando acceso a financiación a PYMES y enfocándose en tres principios clave dentro del marco de los ODS:

- ODS 2 – Hambre 0 y seguridad alimentaria, promocionando agricultura sostenible.

- ODS 12 – Asegurar la producción y consumo responsables.

- ODS 8 – Promocionar trabajo decente y crecimiento económico.

El equipo está compuesto por diez profesionales, gran parte del equipo miembros senior con más de 10 años de experiencia en mercados emergentes y/u operaciones financieras, y experiencia colectiva en financiación de más de 1 billón de dólares de deuda a corto plazo y transacciones comerciales de mercados emergentes.

Puedes saber más sobre el equipo aquí.

WCA también ha sido reconocido como un agente del mercado relevante, y como prueba de ello:

- Asociación con Centro de Comercio Internacional de las Naciones Unidas, en el ámbito de apoyo comercial de actividades enfocadas de género.

- Asociación con la Cámara de Comercio de Kenia.

- Conferenciante en el Foro Mundial de Comercio y Desarrollo - Etiopía

- Conferenciante en la Semana Sostenible de Suiza.

- Conferenciante de la Cumbre Anual de Café de África del Este – Kenia.

- Formador y colaborador en seminarios con la Cámara de Comercio de Kenia y del Centro de Comercio Internacional.

El equipo

Gathuo Njoroge es un experto en finanzas y tecnología con más de 10 años de experiencia en desarrollo de productos, investigación, originación y operaciones de soluciones financieras para PYMEs y corporaciones en los mercados de África Oriental y Estados Unidos.

Ekaterina Kobzareva es una profesional de inversiones experimentada y altamente calificada, con más de 6 años de experiencia en análisis financiero, diligencia debida y estructuración de acuerdos (tanto del lado comprador como vendedor) en diversas industrias.

Modelo de negocio

WCA tiene su sede en Londres y está registrado desde 2017 en la FCA bajo la regulación de blanqueamiento de capitales, financiamiento terrorista y transferencia de fondos. La empresa opera mediante un modelo de empresa financiera comercial recogiendo fondos (en forma de préstamos y/o co-inversiones que provienen normalmente de fondos de impacto institucionales, Instituciones de Desarrollo Financiero (DFIs), y patrimonios privados) y después prestándolos a proyectos en países emergentes. Los ingresos de la empresa provienen del margen de interés neto entre el interés de los prestatarios y el interés pagado por los prestamistas.

El público objetivo de la empresa engloba 2 millones de PYMES con limitaciones financieras (#1.6 millones en África y #0.4 millones en Latam). Concretamente, la empresa tiene como mercado objetivo Perú, Costa Rica, Colombia, Ecuador, Kenia, Ruanda, Tanzania y Etiopia, y preferentemente en la cadena de valor del sector alimentario.

La empresa ha adaptado sus servicios para las PYMES, las más vulnerables a las exigencias de financiamiento transaccional – aproximadamente el 58% de las propuestas de transacciones financieras son rechazadas por los bancos, a pesar de que a nivel global este sector presenta el 44% de todas las propuestas de transacción financiera-. Los bancos rechazan gran parte de las propuestas por tres principales razones: los reguladores imponen requisitos muy engorrosos de AML (prevención blanqueo de capital) y KYC (conocimiento del cliente), requisitos de capital para financiamiento a corto plazo inviables o poco rentables para empresas con baja calificación y limitación de capital bancario.

WCA sigue sus propios principios de inversión responsable basado en los 10 Principios del Pacto Mundial de la ONU.

Activo desde

2018

Pais fiscal

GB

Operando en

"Latin America and Sub Saharan Africa"

Industria

Inversiones

Número de préstamos Goparity

23

Empresas promotoras con mujeres accionistas

Si

Novedades

2023-01-03

Primer pago

El primer pago se pagó a todos los inversores

2022-06-30

100% financiado

533 inversores recaudaron con éxito 115.000€

2022-06-24

Abierto a la inversión

Esta campaña está abierta a la inversión

Suscríbete a nuestra newsletter para estar actualizado sobre nuestras oportunidades de inversión.