Compartir

Liquidado por el promotor

Cacao de Equador III

Guayas Province, EC

pagos

semestral

plazo

6 meses

interés anual

4.5%

rating riesgo

B+

Capital circulante para empresa familiar de productores de cacao.

Descripción

El objetivo de esta campaña es financiar una empresa familiar ubicada en la zona costera de la Provincia de Guayas (Ecuador), dedicada a la agregación, procesamiento y venta de granos de cacao y derivados (licor, manteca y polvo) para Europa y América del Norte.

Fundada en 1996 por un empresario local, la empresa es una de las principales exportadoras nacionales de “Cacao Arriba”, un cacao especial de aroma floral del Ecuador, y de chocolate premium con un proceso industrial "bean to bar" y origen rastreable de las regiones cacaoteras más representativas del país.

Con dos fábricas en las provincias de Guayas y Los Ríos, la empresa tiene una capacidad de exportación total de 20.000 TM al año.

Debido al crecimiento de las multinacionales y al aumento de la competencia local, la empresa ha invertido en la automatización de sus operaciones, mecanización y diversificación de productos para ser más eficiente y competitiva. La tecnología ha permitido duplicar el volumen de producción y exportación; reducir riesgos laborales; acortar los tiempos de preparación de lotes; mejorar la homogeneidad y calidad de los granos; disminuir el margen de error humano en las etapas de producción; optimizar el control de costes; y mejorar la calidad. Además, todos los procesos ahora pueden ser gestionados de forma remota desde un ordenador.

La misión de la empresa es exportar el mejor cacao ecuatoriano, promoviendo el comercio justo con pequeños productores y comerciantes, garantizando altos estándares de calidad y responsabilidad con las personas y el medio ambiente.

La empresa obtiene su producción de alrededor de 2.500 productores de cacao y se centra en mejorar su productividad y control de calidad, implementando dos programas que benefician a 5.000 familias:

- Programa de Calidad, Trazabilidad y Sostenibilidad, que ofrece asistencia técnica y capacitación a las comunidades agrícolas para mejorar la productividad; asesoría y apoyo para la mejora de la calidad y postcosecha; formación en gestión financiera y comercial; y prácticas de comercio justo para mejorar la calidad de vida en las comunidades. El objetivo es establecer un sistema de trazabilidad que permita rastrear la información de los granos de cacao en cada uno de los procesos, desde la producción, manejo postcosecha y distribución. La empresa trabaja con asociaciones de pequeños productores en este programa.

- Proyecto de Sostenibilidad, enfocado en mejorar la productividad de los pequeños productores de cacao y su calidad de vida mediante formación técnica. El objetivo principal del programa es obtener granos de cacao con menos grasa y más sabor. Patrocinado por el Gobierno de Sucumbíos (Región Cacaotera) y en coordinación con las principales asociaciones de pequeños productores, este proyecto ha inscrito hasta la fecha a 680 productores de cacao.

La producción de cacao fino representa menos del 5% de la producción mundial de granos de cacao, y Ecuador es el mayor productor, contribuyendo con más de la mitad de esta producción, siendo la materia prima esencial para las industrias de chocolate fino en Europa y América.

La producción de cacao en Ecuador ha mostrado una tendencia general de crecimiento en los últimos años. Se estima que alcanzó 328.000 toneladas en 2019/2020, valoradas en aproximadamente 700 millones de dólares. Esta tendencia continuó en 2020/2021, con una estimación de 340.000 toneladas para esta temporada.

En Ecuador, se cultivan aproximadamente 360.000 hectáreas de cacao por unos 90.000 agricultores. La mayoría de estos agricultores pertenecen a clases de bajos ingresos y trabajan en menos de 10 hectáreas de tierra (según representantes de organizaciones no gubernamentales de Ecuador). Sus ingresos dependen en gran medida de la producción agrícola, siendo casi la mitad procedente de la venta de granos de cacao.

Los fondos recaudados a través de esta campaña se utilizarán como capital circulante transaccional para proporcionar liquidez a la empresa, desde la fase de compras y procesamiento hasta las exportaciones. Esta es la sexta campaña promovida por Working Capital Associates con Goparity, y la segunda para obtener financiación para esta empresa ecuatoriana.

El impacto

Directo:

- Mejorar la salud financiera de los productores pequeños: mediante el suministro de capital circulante transaccional, 2.500 pequeños productores de cacao ecuatorianos podrán tener la liquidez necesaria para un proceso de producción estable.

- Mejorar la productividad de los pequeños productores: proporcionando asistencia técnica y certificaciones orgánicas y de comercio justo, capacitación, educación, apoyo social y de salud a los agricultores y sus familias, la empresa promueve mejores condiciones laborales y acceso a una cadena de exportación internacional para los pequeños productores que poseen menos de dos hectáreas de tierra.

Indirecto:

- Reducción de la pobreza rural: 2.500 familias de pequeños agricultores recibirán un margen de ganancia más alto por su producción, lo que podrá destinarse a más que solo subsistencia.

- Promoción de la producción orgánica y de comercio justo: parte del cacao producido es orgánico y certificado por terceros. El capital circulante permite el apoyo de la empresa a los agricultores que buscan certificaciones orgánicas y de comercio justo. Además, la empresa promueve iniciativas de sostenibilidad que benefician a 5.000 familias.

- Contribución a la protección ambiental: el enfoque ecuatoriano en la poda de los árboles de cacao tiene como objetivo ayudar a los agricultores a aprovechar al máximo lo que ya tienen, para no tener que presionar más hacia la Amazonía. Entre otras técnicas sostenibles se encuentran el cultivo a la sombra, la policulutura, el uso correcto de fertilizantes y pesticidas, incluidos el control natural de plagas y el compostaje. El objetivo es mantener un registro del cacao hasta su entrega final al consumidor, garantizando la trazabilidad en cada uno de sus procesos, desde la producción, manejo post-cosecha y distribución del cacao.

Impact Indicators

856

Personas impactadas

Contribución a los Objetivos

de Desarrollo Sostenible

Objetivos de Desarrollo Sostenible

.359d24f.png)

.d617453.png)

.1830098.png)

Viabilidad Financiera

El Capital Circulante Transaccional es un activo de financiamiento a corto plazo que permite al vendedor recibir pagos anticipados y al comprador retrasar sus pagos. En las ventas comerciales, la práctica estándar de pagos es entre 30 y 90 días desde que el vendedor emite la factura, lo que generalmente afecta la disponibilidad de efectivo del vendedor para sus propias adquisiciones, mientras que el comprador puede retener su efectivo por más tiempo.

Este gap de capital de trabajo se resuelve a través de Capital Circulante Transaccional, sin la necesidad de garantías. Esto resulta en los siguientes beneficios para los pequeños productores y el agregador:

- Liquidez para adquirir productos crudos: el agregador/procesador puede hacer crecer su negocio aumentando la adquisición de materia prima para cumplir con nuevos pedidos de sus compradores internacionales, sin esperar el pago de los compradores existentes.

- Precios Premium: los productores reciben un precio premium que refleja el valor certificado y de comercio justo del cacao, resolviendo la presión de efectivo y eliminando la necesidad de dar descuentos al comprador a cambio de pago anticipado.

- Mayor margen de ganancia que puede ser reinvertido: no solo en la subsistencia, sino también en el fortalecimiento de capacidades técnicas agrícolas, tecnologías, mejorando los estándares de producción y en certificaciones de comercio justo, orgánico y de calidad.

WCA mantiene una Póliza de Seguro de Crédito Comercial con una aseguradora global que proporciona seguros de crédito comercial, fianzas y servicios de cobros a nivel mundial, con presencia estratégica en 50 países. El reembolso del proyecto estará garantizado bajo dicha póliza de seguro, lo que efectivamente protege a los prestamistas de Goparity en caso de eventos de incumplimiento relacionados con el crédito (por ejemplo, insolvencia o quiebra). La póliza cubre pérdidas por Insolvencia, Incumplimiento Prolongado y Riesgo Político y cubre hasta el 90% del valor de la transacción comercial subyacente financiada por WCA. Dado que WCA financia hasta el 80% de cualquier transacción comercial subyacente, la póliza cubre en esencia más que el financiamiento total de WCA.

Download Información Financiera para el Inversor de Financiación Colaborativa (IFIFC)

El Promotor

Sobre WCA (Working Capital Associates) LLP

Working Capital Associates (WCA) se fundó en 2018 por Federica Sambiase – profesional senior del sector financiero y bancario – y CEO de la empresa. Experimentó de primera mano como los bancos comerciales tradicionales no conseguían adaptarse a las necesidades de los prestatarios de PYMES y sus requisitos hechos a medida, especialmente en regiones como SSA y Latam, donde la necesidad de crédito crecía rápidamente.

La visión de WCA refleja más de 20 años de experiencia de su líder en el mundo de las finanzas, así como la pasión por el desarrollo e igualdad de género, madurada y nutrida durante sus años como miembro de la junta directiva de la ONG Care International.

WCA es la única empresa – liderada por mujeres y cuya propiedad es totalmente femenina- que proporciona financiación directa a la cadena de valor de productos agrícolas en África subsahariana (SSA) y Latinoamérica (Latam).

WCA está comprometida con un enfoque de negocio profesional, ético y transparente, efectuando inversiones socialmente responsables “que permiten a los inversores abordar los criterios medioambientales, sociales y de gobernanza empresarial (ASG) mediante la inversión en soluciones específicas, como por ejemplo la energía renovable, gestión de residuos y agua, silvicultura y agricultura, productos de salud e inclusión financiera ” (PRI).

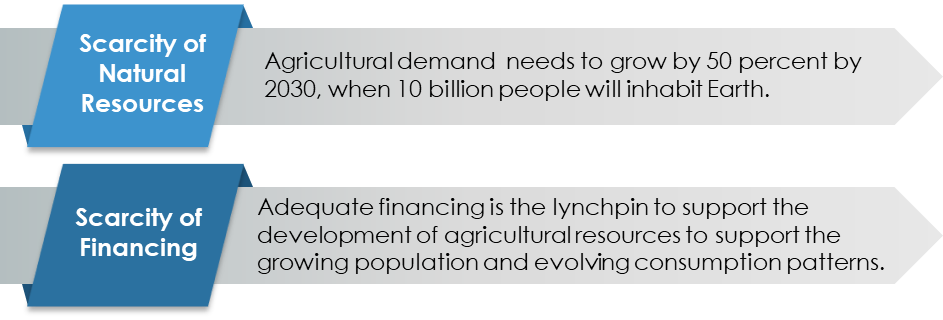

La empresa sigue dos cuestiones clave:

La empresa también aplica inversión en lentes de género, procurando financiar un nivel significativo de negocios liderados por mujeres que siguen los estándares de gestión sostenible y responsable.

El propósito de WCA es aumentar la cadena de valor proporcionando acceso a financiación a PYMES y enfocándose en tres principios clave dentro del marco de los ODS:

- ODS 2 – Hambre 0 y seguridad alimentaria, promocionando agricultura sostenible.

- ODS 12 – Asegurar la producción y consumo responsables.

- ODS 8 – Promocionar trabajo decente y crecimiento económico.

El equipo está compuesto por diez profesionales, gran parte del equipo miembros senior con más de 10 años de experiencia en mercados emergentes y/u operaciones financieras, y experiencia colectiva en financiación de más de 1 billón de dólares de deuda a corto plazo y transacciones comerciales de mercados emergentes.

Puedes saber más sobre el equipo aquí.

WCA también ha sido reconocido como un agente del mercado relevante, y como prueba de ello:

- Asociación con Centro de Comercio Internacional de las Naciones Unidas, en el ámbito de apoyo comercial de actividades enfocadas de género.

- Asociación con la Cámara de Comercio de Kenia.

- Conferenciante en el Foro Mundial de Comercio y Desarrollo - Etiopía

- Conferenciante en la Semana Sostenible de Suiza.

- Conferenciante de la Cumbre Anual de Café de África del Este – Kenia.

- Formador y colaborador en seminarios con la Cámara de Comercio de Kenia y del Centro de Comercio Internacional.

El equipo

Gathuo Njoroge es un experto en finanzas y tecnología con más de 10 años de experiencia en desarrollo de productos, investigación, originación y operaciones de soluciones financieras para PYMEs y corporaciones en los mercados de África Oriental y Estados Unidos.

Ekaterina Kobzareva es una profesional de inversiones experimentada y altamente calificada, con más de 6 años de experiencia en análisis financiero, diligencia debida y estructuración de acuerdos (tanto del lado comprador como vendedor) en diversas industrias.

Modelo de negocio

WCA tiene su sede en Londres y está registrado desde 2017 en la FCA bajo la regulación de blanqueamiento de capitales, financiamiento terrorista y transferencia de fondos. La empresa opera mediante un modelo de empresa financiera comercial recogiendo fondos (en forma de préstamos y/o co-inversiones que provienen normalmente de fondos de impacto institucionales, Instituciones de Desarrollo Financiero (DFIs), y patrimonios privados) y después prestándolos a proyectos en países emergentes. Los ingresos de la empresa provienen del margen de interés neto entre el interés de los prestatarios y el interés pagado por los prestamistas.

El público objetivo de la empresa engloba 2 millones de PYMES con limitaciones financieras (#1.6 millones en África y #0.4 millones en Latam). Concretamente, la empresa tiene como mercado objetivo Perú, Costa Rica, Colombia, Ecuador, Kenia, Ruanda, Tanzania y Etiopia, y preferentemente en la cadena de valor del sector alimentario.

La empresa ha adaptado sus servicios para las PYMES, las más vulnerables a las exigencias de financiamiento transaccional – aproximadamente el 58% de las propuestas de transacciones financieras son rechazadas por los bancos, a pesar de que a nivel global este sector presenta el 44% de todas las propuestas de transacción financiera-. Los bancos rechazan gran parte de las propuestas por tres principales razones: los reguladores imponen requisitos muy engorrosos de AML (prevención blanqueo de capital) y KYC (conocimiento del cliente), requisitos de capital para financiamiento a corto plazo inviables o poco rentables para empresas con baja calificación y limitación de capital bancario.

WCA sigue sus propios principios de inversión responsable basado en los 10 Principios del Pacto Mundial de la ONU.

Activo desde

2018

Pais fiscal

GB

Operando en

"Latin America and Sub Saharan Africa"

Industria

Inversiones

Número de préstamos Goparity

23

Empresas promotoras con mujeres accionistas

Si

Novedades

2022-04-28

Primer pago

El primer pago se pagó a todos los inversores

2021-10-28

100% financiado

520 inversores recaudaron con éxito 125.000€

2021-10-25

Nuevo objetivo

Después de recaudar 100.000€ en menos de tres dias, el promotor decidió aumentar el monto de inversión global de su campaña para 125.000 €. Todas las demás condiciones de la oferta serán las mismas.

2021-10-22

Abierto a la inversión

Esta campaña está abierta a la inversión

Suscríbete a nuestra newsletter para estar actualizado sobre nuestras oportunidades de inversión.