Compartir

100% Financiado por 459 inversores

Cacao del Ecuador II

Guayas Province, EC

cuota

semestral

plazo

6 meses

interés anual

4.65%

nivel de riesgo

B+

Capital de trabajo para empresa familiar de productores de cacao

Descripción

El objetivo de esta campaña es financiar una empresa familiar ubicada en la zona costera de la Provincia de Guayas (Ecuador), que se dedica a la agregación, procesamiento y venta de productos de cacao para Europa, América del Norte y Asia. La empresa obtiene su cacao de la producción de 2.500 agricultores en las provincias de Los Ríos (la zona con la mayor producción del mundialmente conocido 'Cacao Nacional', también denominado 'Cacao Arriba'), Sucumbíos y Orellana (donde se encuentra la producción de cacao diferenciada por la influencia de la Reserva de la Biosfera Yasuni), y El Oro.

Cuando los comerciantes europeos descubrieron un "cacao especial" con aroma floral en el Golfo de Guayaquil, preguntaron a los comerciantes sobre el origen de estos granos increíbles. Los locales respondieron “Arriba” - “río arriba”, es decir, cuanto más arriba en las cuencas de los ríos que llegan al golfo. Hasta hoy, este cacao es conocido en Ecuador como “Cacao Arriba”.

La empresa tiene como objetivo acortar las largas cadenas de suministro que dificultan el acceso de los agricultores al mercado y mejorar su productividad y control de calidad a través de dos programas de capacitación, que benefician a 5.000 familias. Su misión es exportar los mejores granos de cacao ecuatoriano y sus derivados, promoviendo el comercio justo y garantizando estándares de calidad y responsabilidad hacia las personas y el medio ambiente.

Ecuador es el segundo productor de cacao en América Latina después de Brasil y el mayor productor mundial de cacao fino o aromatizado.

La producción de cacao fino representa menos del 5% de la producción mundial de granos de cacao, y Ecuador es el mayor productor, contribuyendo con más de la mitad de esta producción. Este cacao es la materia prima necesaria para las industrias europeas y estadounidenses en la elaboración de chocolate fino.

La producción de cacao en Ecuador ha mostrado una tendencia general de crecimiento en los últimos años. Se estima que alcanzó las 328 mil toneladas en 2019/2020, lo que equivale a aproximadamente 700 millones de dólares. Esta tendencia se mantuvo en 2020/2021, estimándose que alcanzará las 340 mil toneladas en esta temporada.

En Ecuador, aproximadamente 360.000 hectáreas de cacao son cultivadas por alrededor de 90.000 agricultores. La mayoría de estos agricultores pertenecen a la clase baja y trabajan en menos de 10 hectáreas de tierra (según representantes de organizaciones no gubernamentales del Ecuador). Sus ingresos dependen en gran parte de la producción agrícola, siendo casi la mitad provenientes de la venta de granos de cacao.

Los fondos recaudados con esta campaña se utilizarán como capital circulante transaccional para proporcionar liquidez a la empresa, desde la fase de compras y procesamiento hasta las exportaciones. Esta es la sexta campaña promovida por Working Capital Associates con GoParity y la segunda para obtener financiamiento para esta empresa ecuatoriana.

El impacto

Directo:

Mejores condiciones laborales y financieras para pequeños productores, que poseen menos de 10 hectáreas de tierra. La empresa ha establecido un programa de sostenibilidad que ofrece a las comunidades agrícolas los siguientes servicios: asistencia técnica y capacitación para mejorar la productividad; asesoramiento y apoyo para mejorar la calidad del poscosecha; capacitación para desarrollar capacidades de gestión, financieras y comerciales en las comunidades; prácticas de comercio justo para mejorar la calidad de vida en las comunidades.

Promoción de la igualdad de género: la empresa es propiedad total de su CEO femenina, quien dirige un equipo sénior y experimentado.

Indirecto:

Promoción de una cadena de valor inclusiva al unir a 5.000 productores locales que tienen acceso a una cadena de valor de exportación internacional.

Contribución a la misión social de la empresa, asegurando pagos en efectivo y primas directamente en la finca a los agricultores, y pagos anticipados a un precio superior a la empresa. Luego, la empresa puede reinvertir el dinero en capacitación, educación, apoyo social a los agricultores y sus familias, apoyo sanitario y ayuda con certificaciones orgánicas y de comercio justo.

Reducción de la pobreza rural: los pequeños productores recibirán un margen de ganancia más alto por sus productos, lo que puede destinarse a algo más que la mera subsistencia. También tendrán acceso a mercados nacionales e internacionales más amplios.

Contribución a la protección del medio ambiente: el enfoque ecuatoriano se centra en la poda de los árboles de cacao y tiene como objetivo ayudar a los agricultores a aprovechar al máximo lo que ya tienen, para que no necesiten presionar más hacia la Amazonía. Entre otras técnicas sostenibles se encuentran el cultivo bajo sombra y el cultivo múltiple, así como el uso correcto de fertilizantes y pesticidas, incluido el control natural de plagas y el compost. El objetivo es mantener un registro del cacao hasta su entrega final al consumidor, garantizando la trazabilidad en cada uno de sus procesos, desde la producción, el manejo poscosecha y la distribución del cacao.

Impact Indicators

685

Personas impactadas

Contribución a los Objetivos

de Desarrollo Sostenible

Objetivos de Desarrollo Sostenible

.359d24f.png)

.d617453.png)

.1830098.png)

Viabilidad Financiera

El capital circulante transaccional es un activo financiero de deuda a corto plazo que permitirá a la empresa recibir pagos anticipados y a sus clientes retrasar sus pagos.

Es una práctica común en el comercio que el plazo de pago varíe entre 30 y 90 días a partir de la fecha de emisión de la factura por parte del vendedor. Este plazo, que permite al comprador mantener sus fondos durante más tiempo, perjudica al vendedor al quitarle liquidez. Generalmente, este problema se resuelve mediante financiación bancaria, que exige garantías sobre activos duraderos (es decir, fábricas, edificios, máquinas, etc.) en caso de incumplimiento. Estas garantías "excesivas" suelen tener un valor sustancialmente más alto que el préstamo en cuestión. Por ejemplo, un préstamo de 10 dólares puede exigir un activo por valor de 150 dólares como garantía en caso de incumplimiento. Así, estos préstamos rara vez resuelven el problema, ya que estas garantías rara vez están al alcance de los pequeños agricultores, cuyos únicos activos suelen ser sus tierras.

El capital circulante viene a resolver este problema, ofreciendo las siguientes ventajas:

Liquidez para la compra de materia prima: el productor ahora tiene la capacidad de comprar materias primas para responder a nuevos pedidos de compra, sin tener que esperar el pago de los compradores actuales, lo que le permite hacer crecer su negocio. Precios más altos: al eliminar la presión de la liquidez, los productores ya no están obligados a ofrecer descuentos a los compradores a cambio de pagos anticipados, y reciben un precio más alto por el cacao certificado, que refleja su valor real. Margen de beneficio más alto que puede ser reinvertido: con un margen de beneficio más elevado, este dinero no solo garantiza la estabilidad financiera de los productores, sino que también puede ser utilizado para inversión en formación y capacitación, así como en los costos de certificación de producción orgánica y de comercio justo. WCA cuenta con un Seguro de Crédito Comercial otorgado por una aseguradora global que opera en más de 50 países. El pago está garantizado por esta póliza, que protege a los inversores de GoParity en caso de incumplimiento (por ejemplo, insolvencia). Las coberturas de la póliza incluyen pérdidas en caso de insolvencia, incumplimiento prolongado y riesgo político hasta el 90% del valor de la transacción comercial financiada por WCA. Dado que WCA proporciona como máximo el 80% de financiación para cualquier transacción, la póliza en esencia cubre más que la financiación global de WCA.

Download Información Financiera para el Inversor de Financiación Colaborativa (IFIFC)

El Promotor

Sobre WCA (Working Capital Associates) LLP

Working Capital Associates (WCA) se fundó en 2018 por Federica Sambiase – profesional senior del sector financiero y bancario – y CEO de la empresa. Experimentó de primera mano como los bancos comerciales tradicionales no conseguían adaptarse a las necesidades de los prestatarios de PYMES y sus requisitos hechos a medida, especialmente en regiones como SSA y Latam, donde la necesidad de crédito crecía rápidamente.

La visión de WCA refleja más de 20 años de experiencia de su líder en el mundo de las finanzas, así como la pasión por el desarrollo e igualdad de género, madurada y nutrida durante sus años como miembro de la junta directiva de la ONG Care International.

WCA es la única empresa – liderada por mujeres y cuya propiedad es totalmente femenina- que proporciona financiación directa a la cadena de valor de productos agrícolas en África subsahariana (SSA) y Latinoamérica (Latam).

WCA está comprometida con un enfoque de negocio profesional, ético y transparente, efectuando inversiones socialmente responsables “que permiten a los inversores abordar los criterios medioambientales, sociales y de gobernanza empresarial (ASG) mediante la inversión en soluciones específicas, como por ejemplo la energía renovable, gestión de residuos y agua, silvicultura y agricultura, productos de salud e inclusión financiera ” (PRI).

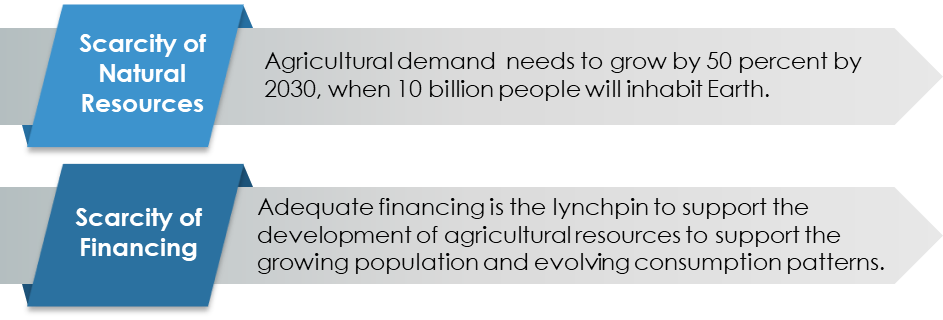

La empresa sigue dos cuestiones clave:

La empresa también aplica inversión en lentes de género, procurando financiar un nivel significativo de negocios liderados por mujeres que siguen los estándares de gestión sostenible y responsable.

El propósito de WCA es aumentar la cadena de valor proporcionando acceso a financiación a PYMES y enfocándose en tres principios clave dentro del marco de los ODS:

- ODS 2 – Hambre 0 y seguridad alimentaria, promocionando agricultura sostenible.

- ODS 12 – Asegurar la producción y consumo responsables.

- ODS 8 – Promocionar trabajo decente y crecimiento económico.

El equipo está compuesto por diez profesionales, gran parte del equipo miembros senior con más de 10 años de experiencia en mercados emergentes y/u operaciones financieras, y experiencia colectiva en financiación de más de 1 billón de dólares de deuda a corto plazo y transacciones comerciales de mercados emergentes.

Puedes saber más sobre el equipo aquí.

WCA también ha sido reconocido como un agente del mercado relevante, y como prueba de ello:

- Asociación con Centro de Comercio Internacional de las Naciones Unidas, en el ámbito de apoyo comercial de actividades enfocadas de género.

- Asociación con la Cámara de Comercio de Kenia.

- Conferenciante en el Foro Mundial de Comercio y Desarrollo - Etiopía

- Conferenciante en la Semana Sostenible de Suiza.

- Conferenciante de la Cumbre Anual de Café de África del Este – Kenia.

- Formador y colaborador en seminarios con la Cámara de Comercio de Kenia y del Centro de Comercio Internacional.

El equipo

Gathuo Njoroge es un experto en finanzas y tecnología con más de 10 años de experiencia en desarrollo de productos, investigación, originación y operaciones de soluciones financieras para PYMEs y corporaciones en los mercados de África Oriental y Estados Unidos.

Ekaterina Kobzareva es una profesional de inversiones experimentada y altamente calificada, con más de 6 años de experiencia en análisis financiero, diligencia debida y estructuración de acuerdos (tanto del lado comprador como vendedor) en diversas industrias.

Modelo de negocio

WCA tiene su sede en Londres y está registrado desde 2017 en la FCA bajo la regulación de blanqueamiento de capitales, financiamiento terrorista y transferencia de fondos. La empresa opera mediante un modelo de empresa financiera comercial recogiendo fondos (en forma de préstamos y/o co-inversiones que provienen normalmente de fondos de impacto institucionales, Instituciones de Desarrollo Financiero (DFIs), y patrimonios privados) y después prestándolos a proyectos en países emergentes. Los ingresos de la empresa provienen del margen de interés neto entre el interés de los prestatarios y el interés pagado por los prestamistas.

El público objetivo de la empresa engloba 2 millones de PYMES con limitaciones financieras (#1.6 millones en África y #0.4 millones en Latam). Concretamente, la empresa tiene como mercado objetivo Perú, Costa Rica, Colombia, Ecuador, Kenia, Ruanda, Tanzania y Etiopia, y preferentemente en la cadena de valor del sector alimentario.

La empresa ha adaptado sus servicios para las PYMES, las más vulnerables a las exigencias de financiamiento transaccional – aproximadamente el 58% de las propuestas de transacciones financieras son rechazadas por los bancos, a pesar de que a nivel global este sector presenta el 44% de todas las propuestas de transacción financiera-. Los bancos rechazan gran parte de las propuestas por tres principales razones: los reguladores imponen requisitos muy engorrosos de AML (prevención blanqueo de capital) y KYC (conocimiento del cliente), requisitos de capital para financiamiento a corto plazo inviables o poco rentables para empresas con baja calificación y limitación de capital bancario.

WCA sigue sus propios principios de inversión responsable basado en los 10 Principios del Pacto Mundial de la ONU.

Activo desde

2018

Pais fiscal

GB

Operando en

"Latin America and Sub Saharan Africa"

Industria

Inversiones

Número de préstamos Goparity

23

Empresas promotoras con mujeres accionistas

Si

Novedades

2022-03-17

Fin del proyecto

Este proyecto ha alcanzado con éxito la madurez de su plan de pagos. Todos los inversores han recibido su capital invertido e intereses completos. Sin embargo, ¡su impacto seguirá creciendo durante muchos años más!

2022-01-06

Primer pago

El primer pago se pagó a todos los inversores

2021-07-06

100% financiado

454 inversores recaudaron con éxito 100.000€

2021-06-28

Abierto a la inversión

Esta campaña está abierta a la inversión

Suscríbete a nuestra newsletter para estar actualizado sobre nuestras oportunidades de inversión.