Share

Settled by the promoter

WCA network

London, GB

instalment

biannual

term

6 months

yearly interest

4.95%

risk rating

B

Refinancing working capital for agriculture and value chains.

Description

Working Capital Associates provides direct financing to value chains of agriculture products from Sub-Saharan Africa (SSA) and Latin America (Latam). So far, the company has raised 2.945.000€ through Goparity to fund four different organizations: a coffee cooperative in Peru (Peruvian Resilient Farming I, II, and III); a cocoa company in Peru (Resilient Cocoa Farming I, II, III, and IV); a family-owned cocoa company in Ecuador (Ecuadorian Cocoa Farming I, II, III, IV, V, VI, VII, VIII, IX and X); and family-owned company based in Kenya active in processing and exporting macadamia nuts (Macadamia Nuts I, II, III, and IV).

In total, this is the twentieth-second campaign promoted by WCA with Goparity. Seventeen out of the previous twenty-one campaigns have reached payment plan maturity. All investors received their capital back, a total amount of 2.215.000€, and corresponding interest.

The funds raised in this campaign will serve as Export & Transactional Finance to refinance the following pipeline of projects:

|

Client |

Country

|

Product | Activity |

| Amazonas

|

Peru | Cocoa | A company specialising in the aggregation and sale of cocoa products. The company’s business focuses mainly on the export of three types of cocoa beans: Organic and Fair Trade, Conventional and Fine Aroma cocoa.

|

| Aroma

|

Ecuador

|

Cocoa

|

Specializes on the aggregation of cocoa from producers and intermediaries, its preparation for further transactions and sale on local and export markets.

|

| Cenfrocafe'

|

Peru

|

Coffee

|

The 6th largest cooperative in Peru, with over 3,200 associated families. Cenfrocafe was founded in 1999, after the global coffee crisis of the early 1990s, when twenty producers organised to sell their crops more efficiently. By working with other groups, the growers of Cenfrocafe could increase their revenues and invest in modernising production.

|

| Cepromar

|

Ecuador

|

Fish

|

A company specialising in the procurement of fresh fish, processing and export of frozen fish and value-added products for international markets.

|

| Coopaser

|

Peru

|

Cocoa

|

A Cooperative located in Madre de Dios that specializes in cocoa products. It was established in 2014 with the support of Aider - Althelia, and since then has grown from 21 producing associates to 339. Their cocoa is Fairtrade and Organic certified. The Company’s main business is focused on collecting cocoa beans from its producing associates and fermentation and drying of beans for further export to Europe.

|

| EcoKakao

|

Ecuador | Cocoa | A family-owned company based in Guayaquil (Ecuador) specialising on aggregation, processing and sale to Europe, North America and Asia of conventional cocoa, special cocoa and semi-finished cocoa products.

|

| Gisha

|

Uganda

|

Coffee | Gisha Coffee was incorporated in 2014 as a private limited liability company to procure, process, and export-ready green coffee and roasted coffee beans. The company’s management states that its primary function is to bridge the gap between coffee farmers and roasters in a sustainable and traceable way at competitive prices and terms.

|

| Pacfish

|

Ecuador | Fish | A company specialising in processing and exporting frozen fish and shrimp produce for international markets.

|

| Pongarbel

|

Ecuador

|

Cocoa, bananas

|

A family-run company managing property la Hacienda “SAN JOSE”, it is specialized in the production and distribution of bananas, cacao, African oil palm and other crops. The company was established in 1997 when 200ha were purchased mostly for cultivating short-cycle crops. As of today, Pongarbel owns more than 1.050ha

|

| Privamnuts

|

Kenya

|

Nuts | A based company specialising in the aggregation, processing, and sale of macadamia nuts for international markets.

|

| San Gallan

|

Peru | Fresh vegetables

|

A B-Corp certified producer of green asparagus, pomegranates and blueberries. The main economic activity of the company is the planting, production and cultivation of high-value fresh fruits and vegetables, mainly destined for export markets such as the United States, the UK, China and several European countries.

|

| Tocache | Peru

|

Cocoa | A Cooperative organization with 30+ years of history that unites 481 producers of cocoa beans and centralizes administrative, governance and business functions to better represent its associates on international markets. The Company was born in 1987 as Comité Central de Productores Agropecuarios Tocache (Central Committee of agricultural producers Tocache), and in 1990 its legal status was changed to Cooperativa Agraria “TOCACHE” Ltda.

|

| Winrep

|

Ecuador | Shrimp

|

A company specialising in processing and exporting shrimp produce for international markets.

|

The Impact

This campaign is one of several to fund a pipeline of projects in Peru, Ecuador, Uganda and Kenya.

Direct

- Improvement of small-holder farmers and cooperatives financial health: small-scale farmers and cooperatives receive better financial conditions and higher profit margin for their produce, when gaining access to international markets.

Indirect

- Enabling agricultural efficiency and reducing rural poverty: market access has been identified as one of the most relevant factors influencing the performance of small-scale producers in developing countries and, hence, one of the enablers of agricultural efficiency, a vital opportunity to reduce rural poverty. WCA provides smallholder access to markets via value chains.

- Promotion of gender equality: WCA is a female-owned and -led company. In addition, the company applies a gender-lens to its investments and seeks to finance businesses that have the appropriate governance and responsible management standards to allow women to grow successfully in their work environment.

Contribution to the Sustainable

Development Goals

Sustainable Development Goals

.4efc673.png)

.b54aa7b.png)

The Promoter

About WCA (Working Capital Associates) LLP

WCA was founded in 2018 by Federica Sambiase – a senior banking & finance professional - who is also the company’s CEO, and who experienced first-hand how traditional commercial banks were not able to adapt to the needs of SME borrowers and to their tailor-made products requirements, especially in regions such as SSA and Latam, where the need for credit is rapidly increasing.

The vision behind WCA was to combine Federica’s 20+ years of finance expertise with her gender-focused and development passion, matured and nurtured as a Board Member with the international NGO Care International.

WCA is the only female-owned and led company providing direct financing to value chains of agriculture products from Sub Saharan Africa (SSA) and Latin America (Latam).

WCA follows a themed responsible investment approach which “allows investors to address ESG issues by investing in specific solutions to them, such as renewable energy, waste, and water management, sustainable forestry and agriculture, health products and inclusive finance” (PRI).

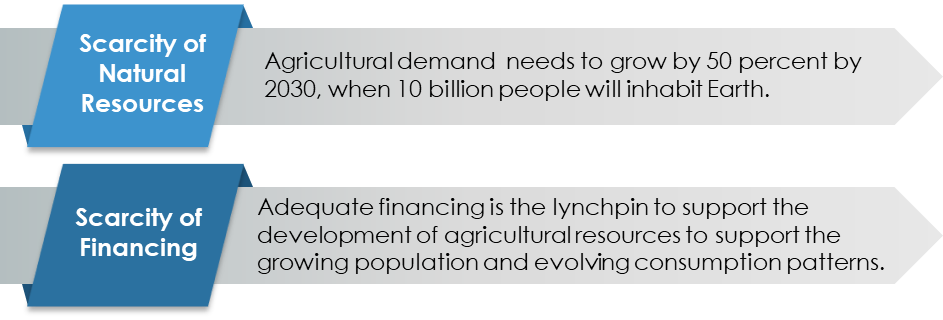

The company follows two key themes:

The company also applies gender-lens to its investments, seeking to finance a significant level of female-led businesses that follow sustainable and responsibly managed standards.

WCA’s goal is to grow value chains by providing access to finance to SMEs, in the framework of three keys SDGs:

- SDG 2 - End hunger, achieve food security, and promote sustainable agriculture.

- SDG 12 - Ensure sustainable consumption and production patterns.

- SDG 8 - Promote inclusive and sustainable economic growth, employment, and decent work for all

The company also applies a “No Harm” Impact Goal, when reviewing its investment opportunities and applying a negative screening to harmful/controversial products and industries.

The team is composed of ten professionals, with senior executive team members having 10+ years of experience in Emerging Markets and/or Trade Finance, and a collective experience in financing over USD1 billion in short-term debt and Emerging Markets transactions.

WCA has also been recognized as a relevant industry player, as evidenced by:

- Partnership with the United Nations’ International Trade Centre, in the context of their gender-focused trade support activities.

- Partnership with the Kenya Chamber of Commerce.

- Panel Speaker at the World Trade Development Forum – Ethiopia.

- Panel Speaker at Sustainability Week Switzerland.

- Panel Speaker at East Africa Coffee Annual Summit - Kenya.

The team

Business Model

WCA is headquartered in London and registered with the FCA under the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations 2017. The company operates using a “commercial finance company” model, by raising funds (in the form of loans and/or co-investments) from international investors, which it then on-lends to borrowers in their target markets.

The company’s revenue comes from the net interest margin between interest received from the borrowers and interest paid to the lenders.

Traditionally, the funds obtained come from impact funds, credit funds, Development Finance institutions (DFIs), and private wealth seeking thematic investments, which provide the company with medium to long-term funding.

The company’s target market is comprised of 2million SMEs that are financially constrained across Africa (#1.6million) and Latam (#0.4million). Specifically, the company is focusing on Peru, Costa Rica, Colombia, Ecuador, Kenya, Rwanda, Tanzania and Ethiopia, with a preference for food value chains.

The company has tailored its services to SMEs, these suffering from the highest levels of transactional financing requests – approximately 58% of transactional finance proposals are rejected by banks, despite the sector globally submitting 44% of all transactional finance proposals. Banks reject such a high volume of proposals for three specific reasons: very cumbersome AML/KYC requirements imposed by regulators, capital requirements such that short-term financing to lower-rated enterprises is unprofitable and constraints on banks’ capital.

WCA follows the Principles for Responsible Investments based on the Ten Principles of the United Nations Global Compact.

In addition to this, WCA has established ESG standards related to investments in controversial sectors and products. The company believes that certain industries, countries, and/or sectors are not compatible with its principles, and therefore will refrain from financing companies that are against its sustainability values.

Active since

2018

Fiscal country

GB

Operating In

"Latin America and Sub Saharan Africa"

Industry

Investment

Number of Goparity Loans

23

Women Shareholders

Yes

Updates

2023-11-06

First payment

First instalment was paid to all the investors

2023-11-06

Project End

This project has successfully reached its payments plan maturity. All investors have received their full capital invested and interest. Nevertheless, its impact will keep growing for many more years!

2023-04-25

100% funded

1353 investors successfully raised 250.000€

2023-04-20

Open for investment

This campaign is open for investment

Sign up to our newsletter and stay up-to-date on our investment opportunities