Share

100% funded by 238 investors

Peruvian Resilient Farming II

Peru, PE

instalment

quarterly

term

3 months

yearly interest

5%

risk rating

B+

Early financing to a Cooperative of small coffee producers in Peru.

Description

The goal of this campaign is to provide early financing to a Cooperative that brings together 3.200 families that produce certified, organic, specialty coffee in the Northern Highlands of Peru at 1,000+ meters above sea level.

These families (93% of which are smallholder farmers, holding a land of less than 5 hectares) are aggregated into a social purpose entity – a Cooperative – whose goal is to provide the farmers with Environmental, Social and Governance (ESG) services in order to improve their productivity and respond to their social needs. These services include training, health, family, and wellbeing support, as well as help with fair-trade and organic certifications.

The growth of organic coffee production in these regions has boomed over the last 20 years, spearheading Peru as a major producer of organic coffee (at about 90,000 ha of certified organic land, Peru is the world’s second-largest exporter of organic coffee), a business that generates 1.5 million jobs involving approximately 223,000 families.

Such phenomenal growth of organic products emerged from unintended circumstances – given the fact that products contained low levels of chemical fertilizers and pesticides due to their unaffordability – customers saw these products with enhanced interest.

To accommodate the increasing demand and due to the farmers’ inefficient production methods - a consequence of their lack of capital - the growth in these regions has been mainly achieved from opening up new areas to commercial agriculture causing Amazonian deforestation – making such growth unsustainable and with a high environmental cost.

The funds raised through this campaign will be used as Transactional Working Capital to provide liquidity to the Cooperative. Transactional Working Capital is a short-term debt financing asset that allows the producer/aggregator/seller to receive early payments and the buyers to delay their payments.

In commercial sales, standard market practice for payments is between 30 to 90 days from the time when the seller issues its invoice – such payment terms usually strain the cash availability of the seller, while allowing the buyer to hold on to their cash for longer. Often times, the seller’s working capital gap is resolved by accessing traditional bank financing, which usually requires to be over-collateralized over hard assets (i.e. factories, buildings, machineries). However, due to the elevated requirements demanded by banks as guarantees for the loans, impossible to meet for smallholders, such bank loans seldom resolve any working capital gap.

Transactional Working Capital fills this gap without the need for collateral. That, in turns, obtains the following results for both the smallholders and the aggregator:

- Premium Prices - The producers receive a premium price that reflects the value of the coffee, resolving the cash pressure and eliminating the need to provide discounts to the buyer, in return for early payment.

- Higher profit margin that can be reinvested: the higher profit margin can then be allocated not only to pure subsistence but to invest in capacity building of technical agricultural skills & technologies, improving production standards and yield investments in organic, fair trade and quality certifications.

WCA maintains a Trade Credit Insurance Policy with a global insurance company providing worldwide trade credit insurance, surety, and collections services, with a strategic presence in 50 countries. The Project repayment will be guaranteed under such Trade Credit Insurance Policy, which effectively protects GoParity lenders from default in a credit related (e.g. insolvency, bankruptcy). The policy covers against losses from Insolvency, Protracted Default and Political Risk and covers up to 90% of the value of the underlying commercial transaction financed by WCA. As the latter provides up to 85% financing to any underlying commercial transaction, the policy in essence covers more than WCA’s entire financing.

The Impact

The Project's

- Promoting an inclusive value chain: aggregating 3.200 coffee producers who will have an active part on the Cooperative’s work;

- Improving working and financial conditions for small producers: 93% of the 3.200 families covered by the project own less than 5 hectares of land;

- Facilitating the Cooperative’s social mission: by ensuring early payments at a premium to the Cooperative, the latter can then reinvest the money in training, education, social support to the farmers and their families, health support and help with organic and fair trade certifications;

- Reducing rural poverty: the smallholders will receive a higher profit margin for higher value-added products (when compared to traditional “commodity coffee”) which can be allocated not only to pure subsistence. They will also have access to larger national and international markets;

- Promoting the growth of organic products: all the coffee produced is organic and certified, containing low levels of chemical fertilizers and pesticides;

- Contributing to the environmental protection of the Selva Region, in the Peruvian Northern Highlands: in order to meet increasing demand and due to the farmers’ inefficient production methods (a consequence of the lack of capital), the growth in the Selva Region has been mainly achieved so far through Amazonian deforestation - a growth that is not sustainable and is coming at a high environmental cost.

The Company's

- Enabling agricultural efficiency and reducing rural poverty: market access has been identified as one of the most relevant factors influencing the performance of small-scale producers in developing countries and, hence, one of the enablers of agricultural efficiency, a vital opportunity to reduce rural poverty. WCA provides smallholder access to markets via value chains;

- Promoting gender equality: WCA is a female-owned and -led company. In addition, the company applies a gender-lens to its investments and seeks to finance businesses that have the appropriate governance and responsible management standards to allow women to grow successfully in their work environment.

Impact Indicators

1.600

people impacted

Contribution to the Sustainable

Development Goals

Sustainable Development Goals

.64a95ce.png)

.4efc673.png)

.39b0412.png)

Financial viability

The loan obtained through Goparity investors will be repaid from coffee sales as follows:

- The loan amount is considerably lower than the total amount financed by the WCA, which will create a financial buffer.

- Repayment comes from buyers in Western markets with a history of successful payments to the Cooperative over several years.

- Loan repayment is protected by trade credit insurance.

Download Key Investment Information Sheet

The Promoter

About WCA (Working Capital Associates) LLP

WCA was founded in 2018 by Federica Sambiase – a senior banking & finance professional - who is also the company’s CEO, and who experienced first-hand how traditional commercial banks were not able to adapt to the needs of SME borrowers and to their tailor-made products requirements, especially in regions such as SSA and Latam, where the need for credit is rapidly increasing.

The vision behind WCA was to combine Federica’s 20+ years of finance expertise with her gender-focused and development passion, matured and nurtured as a Board Member with the international NGO Care International.

WCA is the only female-owned and led company providing direct financing to value chains of agriculture products from Sub Saharan Africa (SSA) and Latin America (Latam).

WCA follows a themed responsible investment approach which “allows investors to address ESG issues by investing in specific solutions to them, such as renewable energy, waste, and water management, sustainable forestry and agriculture, health products and inclusive finance” (PRI).

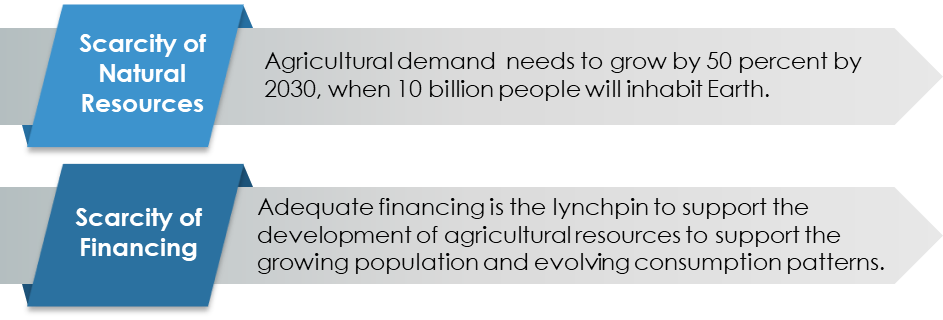

The company follows two key themes:

The company also applies gender-lens to its investments, seeking to finance a significant level of female-led businesses that follow sustainable and responsibly managed standards.

WCA’s goal is to grow value chains by providing access to finance to SMEs, in the framework of three keys SDGs:

- SDG 2 - End hunger, achieve food security, and promote sustainable agriculture.

- SDG 12 - Ensure sustainable consumption and production patterns.

- SDG 8 - Promote inclusive and sustainable economic growth, employment, and decent work for all

The company also applies a “No Harm” Impact Goal, when reviewing its investment opportunities and applying a negative screening to harmful/controversial products and industries.

The team is composed of ten professionals, with senior executive team members having 10+ years of experience in Emerging Markets and/or Trade Finance, and a collective experience in financing over USD1 billion in short-term debt and Emerging Markets transactions.

WCA has also been recognized as a relevant industry player, as evidenced by:

- Partnership with the United Nations’ International Trade Centre, in the context of their gender-focused trade support activities.

- Partnership with the Kenya Chamber of Commerce.

- Panel Speaker at the World Trade Development Forum – Ethiopia.

- Panel Speaker at Sustainability Week Switzerland.

- Panel Speaker at East Africa Coffee Annual Summit - Kenya.

The team

Business Model

WCA is headquartered in London and registered with the FCA under the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations 2017. The company operates using a “commercial finance company” model, by raising funds (in the form of loans and/or co-investments) from international investors, which it then on-lends to borrowers in their target markets.

The company’s revenue comes from the net interest margin between interest received from the borrowers and interest paid to the lenders.

Traditionally, the funds obtained come from impact funds, credit funds, Development Finance institutions (DFIs), and private wealth seeking thematic investments, which provide the company with medium to long-term funding.

The company’s target market is comprised of 2million SMEs that are financially constrained across Africa (#1.6million) and Latam (#0.4million). Specifically, the company is focusing on Peru, Costa Rica, Colombia, Ecuador, Kenya, Rwanda, Tanzania and Ethiopia, with a preference for food value chains.

The company has tailored its services to SMEs, these suffering from the highest levels of transactional financing requests – approximately 58% of transactional finance proposals are rejected by banks, despite the sector globally submitting 44% of all transactional finance proposals. Banks reject such a high volume of proposals for three specific reasons: very cumbersome AML/KYC requirements imposed by regulators, capital requirements such that short-term financing to lower-rated enterprises is unprofitable and constraints on banks’ capital.

WCA follows the Principles for Responsible Investments based on the Ten Principles of the United Nations Global Compact.

In addition to this, WCA has established ESG standards related to investments in controversial sectors and products. The company believes that certain industries, countries, and/or sectors are not compatible with its principles, and therefore will refrain from financing companies that are against its sustainability values.

Active since

2018

Fiscal country

GB

Operating In

"Latin America and Sub Saharan Africa"

Industry

Investment

Number of Goparity Loans

23

Women Shareholders

Yes

Updates

2021-03-16

Project End

This project has successfully reached its payments plan maturity. All investors have received their full capital invested and interest. Nevertheless, its impact will keep growing for many more years!

2021-02-03

First payment

First instalment was paid to all the investors

2020-11-03

100% funded

236 investors successfully raised 100.000€

2020-10-26

Open for investment

This campaign is open for investment

Sign up to our newsletter and stay up-to-date on our investment opportunities