Share

100% funded by 746 investors

Ecuadorian Cocoa Farming IV

Guayas Province, EC

instalment

biannual

term

6 meses

yearly interest

4.5%

risk rating

B+

Working capital for small cocoa producers feeding the planet.

Description

Working Capital Associates provides direct financing to value chains of agriculture products from Sub-Saharan Africa (SSA) and Latin America (Latam). So far, the company has raised 1.050.000€ through GoParity to fund three different organizations: a coffee cooperative in Peru (Peruvian Resilient Farming I and II); a cocoa company in Peru (Resilient Cocoa Farming I, II, III, and IV); and a family-owned cocoa company in Ecuador (Ecuadorian Cocoa Farming I, II, III).

This is the tenth campaign promoted by WCA with GoParity. Five out of these nine campaigns (total amount of 500.000€ lent) have successfully reached their payments plan maturity. All investors have received their full capital invested and interest.

The goal of this campaign is to fund a family-owned company based in the coastal area of the Guayas Province in Ecuador. The company specializes in aggregation, processing, and sales of conventional cocoa beans and semi-finished products such as Liquor, Butter, and Powder to Europe and North America. The funds raised through this campaign will be used as Transactional Working Capital to provide the company with liquidity for several stages, from procurement and processing stage, all the way through its exports.

The Company was established in 1996 by a local entrepreneur and it has become one of the leading national exporting companies of Ecuador's fine aroma cocoa, as well as special semi and premium gourmet chocolates - with an industrial process "bean to bar", and names of the traceable origin of the geographical areas that are most representative of fine aroma cocoa in Ecuador.

With its two Plants in the Guayas and Los Rios provinces, the Company has a total of 20,000MT export capacity per year. Given growing competition in the market, due to the increasing presence of multinationals, and local competition growth, the Company decided to invest in operations automation, mechanization, and product portfolio diversification to become more efficient and competitive.

The Company developed an innovative operations automation project by using high-end technology machinery specially made for the cocoa sector.

According to the Company, such technological innovations achieved the following results:

- Duplicated production and exports volume.

- Reduced labor risks.

- Reduced time between the preparation of lots.

- Improve and ensure the homogeneity and quality of the beans.

- Reduce the percentage of human error throughout the stages of production.

- Allowed for production costs control.

- Achieved higher quality.

In addition, the Company implemented full automation of the entire factory that allows management of all processes from a computer, laptop, or tablet.

The Company’s mission is to export the best fine Ecuadorian cocoa beans and their derivatives to the world, promoting fair trade with small producers and traders, and integrating the whole agro productive cocoa chain with international markets assuring high-quality standards, responsibility for human resources, and care for the environment.

According to management, the Company has established a traceability system that guarantees information about the cocoa tracing on each of its processes from the production, postharvest handling, and cocoa distribution, to maintain a record of the cocoa until its final delivery to the consumer.

The Company sources its produce from 2.500 cocoa farmers and is focused on improving their productivity and quality controls through two Private Sponsored programs, which benefit 5.000 families, as follows.

1. A Program based on Quality, Traceability, and Sustainability that offers farming communities the following services:

- Technical assistance and training to improve productivity.

- Advice and support for improving the quality and post-harvest.

- Training to develop management, financial, and trading capacities in communities.

- Fairtrade practices to improve life quality in the communities.

The goal is to establish a traceability system to guarantee the trace information of cocoa beans in each one of the processes, from production, postharvest handling, and distribution. The Company works with a group of small-scale producer associations in this program.

2. A sustainable project developed to improve the productivity of small producers of cocoa and to enhance their quality of life by using tools such as technical training and delivery of agricultural inputs. The main objective of the program is to obtain a fine flavored cocoa grain with less fat and more flavor with the sponsorship of the Government of Sucumbíos (Cocoa Region) and in coordination with the main small farmer associations. As of today, 680 cocoa producers enrolled in this program.

Overall, Ecuador is the second producer of cocoa in Latin American after Brazil, and for many years, it has been recognized as the largest fine or flavored cacao producer in the world.

There are two general categories of cocoa beans in the world: “fine or flavor” and “bulk or ordinary”. Fine cocoa production represents less than 5% per year of the world’s cocoa bean production and Ecuador is the largest producer of “fine or flavor” beans, producing over half of the world’s production – the raw material that is required in the European and American industries for fine chocolate production. Evidence from Ecuador suggests that the cocoa premium over the New York Stock Exchange price of fine or flavor cocoa beans is 20% to 30%.

At the end of the 2020/21 crop year, the total volume of cocoa beans graded on the ICE Futures U.S. peaked at 109,599 tonnes of cocoa beans, up from 25,679 tonnes graded during the same period of the preceding cocoa year, with volumes of cocoa beans from Ecuador in ICE Futures U.S. gradings reaching 18,383 tonnes respectively.

In Ecuador, approximately 360,000 hectares of cocoa are cultivated by approximately 90,000 farmers. Most of these farmers are relatively poor and operate on less than 10 hectares of land (according to representatives from non-governmental organizations in Ecuador). Their incomes are largely dependent on agricultural production with almost half generated by the sale of cocoa beans. 85% of cocoa production occurs in the coastal plain region of Ecuador.

The Impact

This is the fourth campaign aimed at providing working capital for the same female-owned company of small cocoa producers in Peru. This is the direct impact of these campaigns:

- Promotion of an inclusive value chain by joining 2.500 local producers who have access to an international export value chain.

- Better working and financial conditions for small producers, who own less than two hectares of land.

- Rural poverty reduction: smallholders will receive a higher profit margin for their produce, which can be allocated to more than pure subsistence.

- Contribution to the Company’s social mission, by ensuring cash payments at the “farm gate” to the farmers and early payments at a premium to the Company. The Company can then reinvest the money in training, education, social support to the farmers and their families, health support and help with organic and fair-trade certifications.

- Incentive to organic product growth: all the cocoa produced is organic and certified by a third party.

- Incentive to reducing child slavery: the chocolate certification guarantees that all the processing and procurement is free of child slave labor, and there is no tolerance for any abusive labor practices.

- Contribution to environmental protection: the Ecuatorian focus on pruning cacao trees, aims to help farmers make the most of what they already had, so they wouldn’t need to press further into the Amazon. Among other sustainable techniques are shade-growing and multi-cropping, as well as the correct use of fertilizer and pesticides, including natural pest control and compost.

Impact Indicators

1.027

people impacted

Contribution to the Sustainable

Development Goals

Sustainable Development Goals

.64a95ce.png)

.4efc673.png)

.39b0412.png)

Financial viability

The funds raised through this campaign will be used as Transactional Working Capital to provide liquidity to the Organization from its procurement and processing stage, all the way through its exports.

Transactional Working Capital is a short-term debt financing asset that allows the seller to receive advance/early payments and the buyers to delay their payments. In commercial sales, standard market practice for payments is between 30 to 90 days from the time when the seller issues its invoice – such payment terms usually strain the cash availability of the seller for its own procurement, while allowing the buyer to hold on to their cash for longer. Often, the seller’s working capital gap is resolved by accessing traditional bank financing, which usually requires to be over-collateralized over hard assets (i.e. factories, buildings, machinery). However, due to the elevated requirements demanded by banks as guarantees for the loans, impossible to meet for smallholders, such bank loans seldom resolve any working capital gap.

Transactional Working Capital fills this gap without the need for collateral. That, in turn, obtains the following results for both the smallholders and the aggregator:

- Liquidity to procure raw produce: the aggregator/processor is able to grow its business by increasing the level of raw material procurement to fulfil new orders for its international buyers, without waiting for payment from existing buyers.

- Premium Prices: the producers receive a premium price that reflects the certified and fair trade value of the cocoa, resolving the cash pressure and eliminating the need to provide discounts to the buyer, in return for early payment.

- A higher profit margin that can be reinvested not only to pure subsistence but also in capacity building of technical agricultural skills and technologies, improving production standards, and yield investments in organic, fair trade, and quality certifications.

WCA maintains a Trade Credit Insurance Policy with a global insurance company providing worldwide trade credit insurance, surety, and collections services, with a strategic presence in 50 countries. The Project repayment will be guaranteed under such Trade Credit Insurance Policy, which effectively protects GoParity lenders from default in a credit-related event (e.g. insolvency, bankruptcy). The policy covers losses from Insolvency, Protracted Default, and Political Risk and covers up to 90% of the value of the underlying commercial transaction financed by WCA. As WCA provides up to 80% financing to any underlying commercial transaction, the policy in essence covers more than WCA’s entire financing.

Download Key Investment Information Sheet

The Promoter

About WCA (Working Capital Associates) LLP

WCA was founded in 2018 by Federica Sambiase – a senior banking & finance professional - who is also the company’s CEO, and who experienced first-hand how traditional commercial banks were not able to adapt to the needs of SME borrowers and to their tailor-made products requirements, especially in regions such as SSA and Latam, where the need for credit is rapidly increasing.

The vision behind WCA was to combine Federica’s 20+ years of finance expertise with her gender-focused and development passion, matured and nurtured as a Board Member with the international NGO Care International.

WCA is the only female-owned and led company providing direct financing to value chains of agriculture products from Sub Saharan Africa (SSA) and Latin America (Latam).

WCA follows a themed responsible investment approach which “allows investors to address ESG issues by investing in specific solutions to them, such as renewable energy, waste, and water management, sustainable forestry and agriculture, health products and inclusive finance” (PRI).

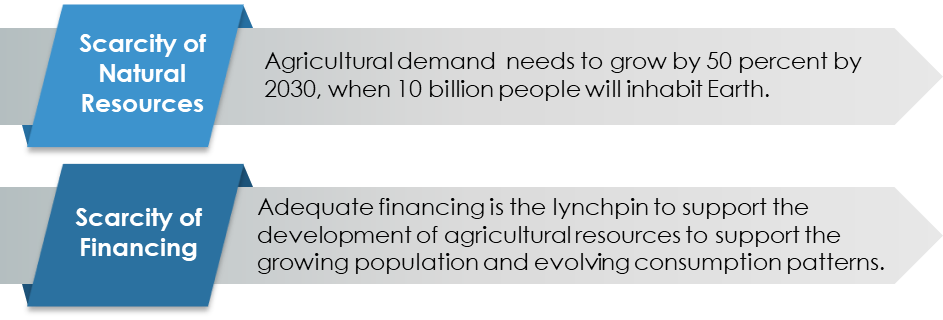

The company follows two key themes:

The company also applies gender-lens to its investments, seeking to finance a significant level of female-led businesses that follow sustainable and responsibly managed standards.

WCA’s goal is to grow value chains by providing access to finance to SMEs, in the framework of three keys SDGs:

- SDG 2 - End hunger, achieve food security, and promote sustainable agriculture.

- SDG 12 - Ensure sustainable consumption and production patterns.

- SDG 8 - Promote inclusive and sustainable economic growth, employment, and decent work for all

The company also applies a “No Harm” Impact Goal, when reviewing its investment opportunities and applying a negative screening to harmful/controversial products and industries.

The team is composed of ten professionals, with senior executive team members having 10+ years of experience in Emerging Markets and/or Trade Finance, and a collective experience in financing over USD1 billion in short-term debt and Emerging Markets transactions.

WCA has also been recognized as a relevant industry player, as evidenced by:

- Partnership with the United Nations’ International Trade Centre, in the context of their gender-focused trade support activities.

- Partnership with the Kenya Chamber of Commerce.

- Panel Speaker at the World Trade Development Forum – Ethiopia.

- Panel Speaker at Sustainability Week Switzerland.

- Panel Speaker at East Africa Coffee Annual Summit - Kenya.

The team

Business Model

WCA is headquartered in London and registered with the FCA under the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations 2017. The company operates using a “commercial finance company” model, by raising funds (in the form of loans and/or co-investments) from international investors, which it then on-lends to borrowers in their target markets.

The company’s revenue comes from the net interest margin between interest received from the borrowers and interest paid to the lenders.

Traditionally, the funds obtained come from impact funds, credit funds, Development Finance institutions (DFIs), and private wealth seeking thematic investments, which provide the company with medium to long-term funding.

The company’s target market is comprised of 2million SMEs that are financially constrained across Africa (#1.6million) and Latam (#0.4million). Specifically, the company is focusing on Peru, Costa Rica, Colombia, Ecuador, Kenya, Rwanda, Tanzania and Ethiopia, with a preference for food value chains.

The company has tailored its services to SMEs, these suffering from the highest levels of transactional financing requests – approximately 58% of transactional finance proposals are rejected by banks, despite the sector globally submitting 44% of all transactional finance proposals. Banks reject such a high volume of proposals for three specific reasons: very cumbersome AML/KYC requirements imposed by regulators, capital requirements such that short-term financing to lower-rated enterprises is unprofitable and constraints on banks’ capital.

WCA follows the Principles for Responsible Investments based on the Ten Principles of the United Nations Global Compact.

In addition to this, WCA has established ESG standards related to investments in controversial sectors and products. The company believes that certain industries, countries, and/or sectors are not compatible with its principles, and therefore will refrain from financing companies that are against its sustainability values.

Active since

2018

Fiscal country

GB

Operating In

"Latin America and Sub Saharan Africa"

Industry

Investment

Number of Goparity Loans

23

Women Shareholders

Yes

Updates

2022-06-07

First payment

First instalment was paid to all the investors

2021-12-07

100% funded

741 investors successfully raised 150.000€

2021-12-01

Open for investment

This campaign is open for investment

Sign up to our newsletter and stay up-to-date on our investment opportunities