Share

Settled by the promoter

Macadamia Nuts III

Mount Kenya, KE

instalment

biannual

term

6 months

yearly interest

4.5%

risk rating

B+

Working capital for small nut producers.

Description

Working Capital Associates provides direct financing to value chains of agriculture products from Sub-Saharan Africa (SSA) and Latin America (Latam). So far, the company has raised 2.073.000€ through GoParity to fund four different organizations: a coffee cooperative in Peru (Peruvian Resilient Farming I, II and III); a cocoa company in Peru (Resilient Cocoa Farming I, II, III, and IV); a family-owned cocoa company in Ecuador (Ecuadorian Cocoa Farming I, II, III, IV, V, VI and VII); and family-owned company based in Keny: Privamnuts, active in processing and exporting macadamia nuts, for which this is the third campaign after Macadamia Nuts I and Macadamia Nuts II.

In total, this is the seventeen campaign promoted by WCA with GoParity. Eleven out of the previous sixteen campaigns have reached payment plan maturity. All investors received their capital back, a total amount of 1.305.000€, and corresponding interest.

Macadamia nuts are butter-flavored nuts obtained from the macadamia trees, native to Australia. Due to their high nutritional value and dietary benefits, these nuts are a popular ingredient in snacks, bakery, and confectionery items. Other applications include cosmetic formulations, beverages, and edible oil (which can be used for cooking, or as salad dressing among others).

Privamnuts, procures the raw macadamia nuts from small farmers, processes them in its plant, and exports them mainly to the US and European markets. The Company has the food safety system certification FSSC 22000 (the highest certification in food safety management system) - a certification that enables an organization to demonstrate its ability to consistently provide safe and quality products that meet customer, applicable statutory, and regulatory requirements. The Company also has Halal and Kosher certifications.

The company sources its Macadamia nuts from the mineral-rich highland soils of Mount Kenya, right through the Equator, with a catchment of over eighty thousand small-scale farmers. The Company relies exclusively on smallholder farmers for the supply of raw macadamia nuts. More than 10,000 are working with the Company, and around 65% of them are female. Collection of raw nuts is done through 150 buying centers, which are managed by field supervisors.

According to the Company, the farmers allow their trees to grow naturally with little intervention, using available natural resources like animal manure, without spraying. The Company prides itself on the relations built with farmers and provides value-added services to the farmers such as training (ranging from training on best agricultural practices to post-harvest care and financial literacy) and inputs (such as a nursery with over 100,000 Macadamia seedlings available to the farmers at subsidized prices to make sure that all farmers have access to quality inputs).

The Company had a direct purchase policy, which ensures that farmers receive a price that is nearly twice that they would receive when selling to brokers. Due to the work of the Company in the region, more and more farmers are interested in diversifying their crops to include macadamia nuts.

The Company has implemented end-to-end quality monitoring systems where the Quality Control team is audited by the Quality Assurance team, ensuring quality control right from farm to the point of sale (quality controllers participate in the collection of the nuts and conduct sample checks of nuts brought by the farmers to make sure they satisfy the Company’s criteria). Complete traceability of every bunch of nuts, and quality checks after every step of processing, assure that the product shipped to the customer corresponds to its technical specifications.

The Company currently has a processing capacity of 7.000 metric tons of nuts in shell per year. This is equivalent to about 1.050 metric tons of exportable products, given a 15% recovery rate. The production process involves drying the nut and reducing moisture.

The plant receives a reliable supply of power from Kenya Power and Lighting co, which has enough solar panels to light the factory during outages, however, they still need to run a generator for the heavy usage needed in cracking. The long-term plan is to increase solar capacity.

At present, Kenya is the third-largest macadamia producer in the world after Australia and South Africa. Kenya’s market share rose from 7,2% in 2009 to 12,2% percent in 2018. Kenya also registered the highest growth in production volumes during this period. Kenya’s macadamia production exploded over the past decade from 11.000 metric tons ‘nut in shell’ (NIS) in 2009 to 42.500 tonnes in 2018. The bulk of Kenyan macadamia is produced by about 200,000 smallholder farmers.

From the 1970’s to today, the macadamia industry has experienced rapid growth, reaching a global crop of 230.000 metric tons (MT) in-shell basis/60.000 MT kernel basis (at 3,5% nut in-shell moisture content (NIS mc)) in 2019. The global production of the macadamia nut has doubled over the past decade, from about 30.000 metric tons in 2010 to about 60.000 metric tons in 2020.

Kenya’s Agriculture and Food Authority (AFA) estimates that, with an increased acreage under the crop, production will reach 60,000 tons NIS by 2022. This would constitute an increase of around 50% when compared with 2019.

The global production forecast indicates that over 440.000 tonnes of NIS will be produced by 2025 and more than 680.000 tonnes over the next ten years compared to around 22.,000 tonnes NIS now produced. The forecast shows that macadamia production growth rate in the coming ten years is expected to be even more significant than during the past decade, i.e. it will double in the next 5 years and triple in the next 10 years, while production doubled during the past 10 years.

The government aims for all macadamia nuts grown in Kenya to be processed locally, as this would empower local processors, advance domestic value addition, secure jobs, and increase farmers’ income. As a result, the processing capacity expanded from 4 processors in 2009 to at least 30 processors by 2018. Since the production is anticipated to grow tremendously in the next 5 years, processors have increased the installed processing capacity to approximately 90.000 tons NIS. There is still ample room for processing expansion, with 50% unused capacity, at present.

The Impact

Direct

- Improvement of small-holder farmers financial health: small-scale farmers receive better financial conditions and higher profit margin for their produce, because the farmers sell directly to the processing company. The Macadamia nuts campaigns in total have an impact on a group of 80.000 farmers, and this campaign alone improves the financial conditions of 20.000 small-scale farmers.

Indirect

- Promotion of organic and quality food production: the Company holds the highest ranking food safety certification, the FSSC 2200. Also, the macadamia nuts production occurs through trees’ growth with little intervention and the use of natural resources. Also, the company has its own macadamia nuts nursery to supply farmers with over 100.000 seedlings which allow an organic production from the nursery to the farms.

- Promotion of clean energy and industry decarbonisation: the processing plant is is powered by solar power in case of grid electricity outage and plans on increasing the solar energy generation capacity.

- Promotion of Kenyan economy: with the nuts processing occurring in Kenya allows for domestic value addition and increase of jobs creation and income.

- Promotion of the company’s CSR policies: the farmers receive technical training on production methods, and supports local clubs and societies.

Impact Indicators

5.000

people impacted

Contribution to the Sustainable

Development Goals

Sustainable Development Goals

.64a95ce.png)

.b54aa7b.png)

Financial viability

The funds raised through this campaign will be used as Transactional Working Capital to provide liquidity to the Company from its procurement and processing stage, all the way through its exports.

Transactional Working Capital fills this gap without the need for collateral. That, in turns, obtains the following results for both the smallholders and the aggregator:

- Liquidity to procure raw produce: the aggregator/processor is able to grow its business by increasing the level of raw material procurement to fulfill new orders for its international buyers, without waiting for payment from existing buyers.

- Premium Prices: the producers receive a premium price that reflects the certified and fair-trade value of the cocoa, resolving the cash pressure and eliminating the need to provide discounts to the buyer, in return for early payment.

- A higher profit margin that can be reinvested not only to pure subsistence but also in capacity building of technical agricultural skills and technologies, improving production standards, and yield investments in organic, fair trade, and quality certifications.

WCA maintains a Trade Credit Insurance Policy with a global insurance company providing worldwide trade credit insurance, surety, and collections services, with a strategic presence in 50 countries. The Project repayment will be guaranteed under such Trade Credit Insurance Policy, which effectively protects GoParity lenders from default in a credit-related event (e.g. insolvency, bankruptcy). The policy covers losses from Insolvency, Protracted Default, and Political Risk and covers up to 90% of the value of the underlying commercial transaction financed by WCA. As WCA provides up to 80% financing to any underlying commercial transaction, the policy in essence covers more than WCA’s entire financing.

Download Key Investment Information Sheet

The Promoter

About WCA (Working Capital Associates) LLP

WCA was founded in 2018 by Federica Sambiase – a senior banking & finance professional - who is also the company’s CEO, and who experienced first-hand how traditional commercial banks were not able to adapt to the needs of SME borrowers and to their tailor-made products requirements, especially in regions such as SSA and Latam, where the need for credit is rapidly increasing.

The vision behind WCA was to combine Federica’s 20+ years of finance expertise with her gender-focused and development passion, matured and nurtured as a Board Member with the international NGO Care International.

WCA is the only female-owned and led company providing direct financing to value chains of agriculture products from Sub Saharan Africa (SSA) and Latin America (Latam).

WCA follows a themed responsible investment approach which “allows investors to address ESG issues by investing in specific solutions to them, such as renewable energy, waste, and water management, sustainable forestry and agriculture, health products and inclusive finance” (PRI).

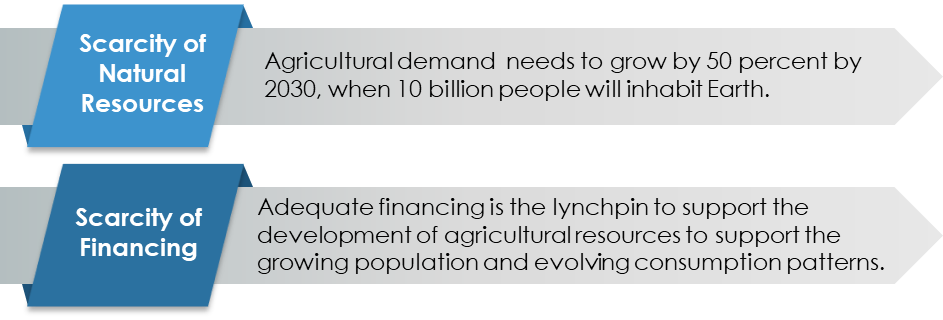

The company follows two key themes:

The company also applies gender-lens to its investments, seeking to finance a significant level of female-led businesses that follow sustainable and responsibly managed standards.

WCA’s goal is to grow value chains by providing access to finance to SMEs, in the framework of three keys SDGs:

- SDG 2 - End hunger, achieve food security, and promote sustainable agriculture.

- SDG 12 - Ensure sustainable consumption and production patterns.

- SDG 8 - Promote inclusive and sustainable economic growth, employment, and decent work for all

The company also applies a “No Harm” Impact Goal, when reviewing its investment opportunities and applying a negative screening to harmful/controversial products and industries.

The team is composed of ten professionals, with senior executive team members having 10+ years of experience in Emerging Markets and/or Trade Finance, and a collective experience in financing over USD1 billion in short-term debt and Emerging Markets transactions.

WCA has also been recognized as a relevant industry player, as evidenced by:

- Partnership with the United Nations’ International Trade Centre, in the context of their gender-focused trade support activities.

- Partnership with the Kenya Chamber of Commerce.

- Panel Speaker at the World Trade Development Forum – Ethiopia.

- Panel Speaker at Sustainability Week Switzerland.

- Panel Speaker at East Africa Coffee Annual Summit - Kenya.

The team

Business Model

WCA is headquartered in London and registered with the FCA under the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations 2017. The company operates using a “commercial finance company” model, by raising funds (in the form of loans and/or co-investments) from international investors, which it then on-lends to borrowers in their target markets.

The company’s revenue comes from the net interest margin between interest received from the borrowers and interest paid to the lenders.

Traditionally, the funds obtained come from impact funds, credit funds, Development Finance institutions (DFIs), and private wealth seeking thematic investments, which provide the company with medium to long-term funding.

The company’s target market is comprised of 2million SMEs that are financially constrained across Africa (#1.6million) and Latam (#0.4million). Specifically, the company is focusing on Peru, Costa Rica, Colombia, Ecuador, Kenya, Rwanda, Tanzania and Ethiopia, with a preference for food value chains.

The company has tailored its services to SMEs, these suffering from the highest levels of transactional financing requests – approximately 58% of transactional finance proposals are rejected by banks, despite the sector globally submitting 44% of all transactional finance proposals. Banks reject such a high volume of proposals for three specific reasons: very cumbersome AML/KYC requirements imposed by regulators, capital requirements such that short-term financing to lower-rated enterprises is unprofitable and constraints on banks’ capital.

WCA follows the Principles for Responsible Investments based on the Ten Principles of the United Nations Global Compact.

In addition to this, WCA has established ESG standards related to investments in controversial sectors and products. The company believes that certain industries, countries, and/or sectors are not compatible with its principles, and therefore will refrain from financing companies that are against its sustainability values.

Active since

2018

Fiscal country

GB

Operating In

"Latin America and Sub Saharan Africa"

Industry

Investment

Number of Goparity Loans

23

Women Shareholders

Yes

Updates

2023-03-23

First payment

First instalment was paid to all the investors

2023-03-23

Project End

This project has successfully reached its payments plan maturity. All investors have received their full capital invested and interest. Nevertheless, its impact will keep growing for many more years!

2023-03-23

First payment

First instalment was paid to all the investors

2022-09-23

100% funded

758 investors successfully raised 110.000€

2022-09-19

Open for investment

This campaign is open for investment

Sign up to our newsletter and stay up-to-date on our investment opportunities