We’ve recently completed scheduled maintenance. If you experience any issues, please clear your cache and refresh the page.

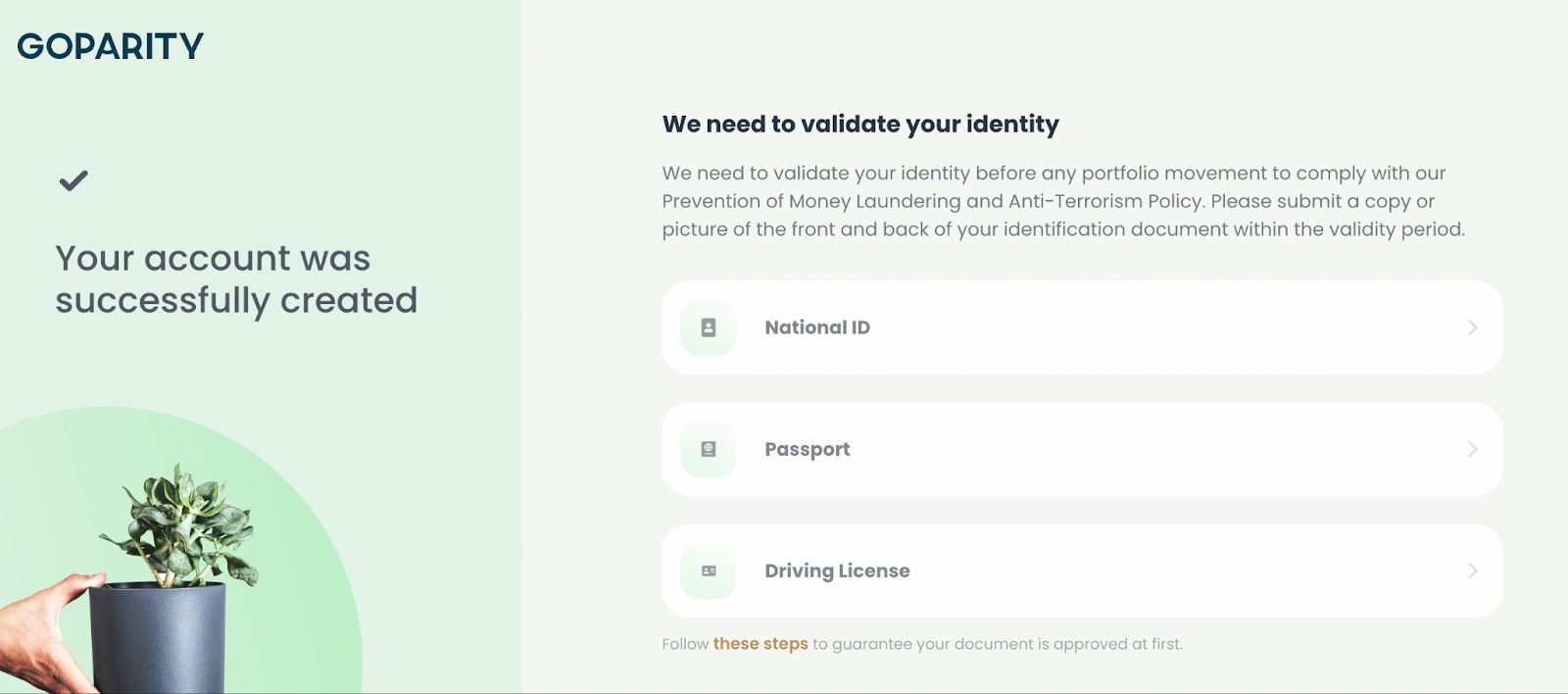

How does the identity validation (KYC) process work?

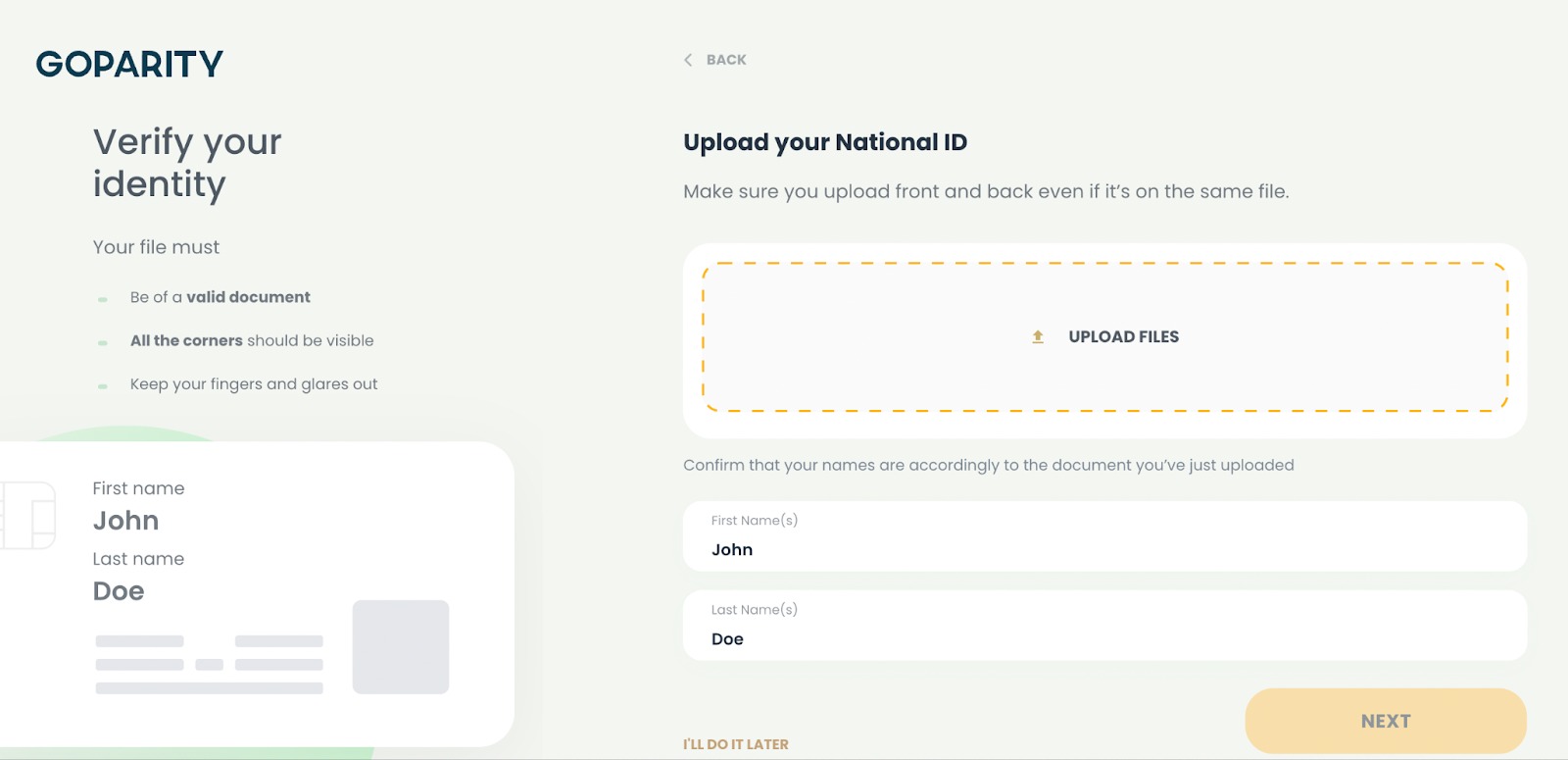

To comply with European regulations, it is mandatory for us to validate the identity of investors before any portfolio activity (e.g., investing in projects). This process requires you to submit a photo of the front and back of your identification document, which must be within its validity period.

The steps are straightforward:

Steps for a quick identity validation:

- Ensure all four corners of the document are visible.

- Verify that your name and surname match exactly as shown on the document.

- Submit a double-sided photo if the document has two sides (including the blank page of your passport).

- Make sure all information is clear and readable, including the MRZ band (no blurs or flashes).

- Accepted documents include ID cards, passports, and driver’s licenses (for European citizens). Other users must submit a passport.

Accepted file formats: JPG, JPEG, PNG, PDF (files between 32 KB and 7 MB).

You will receive confirmation by email within approximately 30 minutes once your identity is validated, and you’ll be ready to start investing!

Go back

Go back