We’ve recently completed scheduled maintenance. If you experience any issues, please clear your cache and refresh the page.

What are the tax retention rates?

Investments in projects whose promoter is tax resident in Portugal are subject to the following taxation:

• Individuals: withholding tax of 28%*

• Legal entities: withholding tax of 25%*

• Individuals or legal entities resident in countries with a privileged tax regime : withholding tax of 35%

* Investors who live in the Autonomous Regions of Azores and Madeira benefit from a reduced withholding tax of 19.6% (for individuals) or 17.5% (for legal entities). To apply this rate, proof of tax residence must be submitted annually to support@goparity.com.

Investments in projects whose promoter is tax resident in Spain (as of May 2024) are subject to the following taxation:

• Tax residents in Spain: 19% withholding tax

• Tax residents in EU countries (excluding Spain): exempt from withholding tax

• Tax residents outside the EU: 19% withholding tax

Investments in projects whose promoter is tax resident in Colombia are subject to the following taxation:

• Tax residents in Colombia: 4% withholding tax

• Tax residents in other countries: 15% withholding tax

** From Q2 2025 onwards, withholding tax will no longer be applied in the Goparity platform for projects whose promotor has tax residence in Colombia (exceptions may apply to ongoing loans).

Investments in projects whose promoter is tax resident in Switzerland are subject to the following taxation:

• All investors are subject to a 35% withholding tax

Investments in projects whose promoter is tax resident in the United Kingdom are subject to the following taxation:

• All investors are subject to a 20% withholding tax

Exceptions may apply to loans with a maturity of 12 months or less.

These rates apply to the interest earned, and its withholding is processed automatically on the platform.

For projects whose promoters are tax residents in Portugal, Power Parity S.A. (the managing entity of Goparity) is responsible for withholding and delivering the tax to the Portuguese Tax Authority.

For projects whose promoters are tax residents outside Portugal, the promoter is responsible for withholding and delivering the tax to the local tax authority in their country of residence.

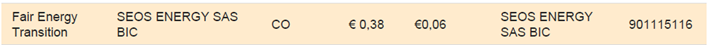

This information is available in the annual income statement issued by Goparity. An example:

Disclaimer:

This information is provided for general guidance purposes only and should not be considered as tax or legal advice. Taxation rules may vary based on individual circumstances, residency, and changes in legislation. Investors are encouraged to consult a qualified tax advisor or legal professional to ensure compliance with the applicable tax laws and to obtain advice tailored to their specific situation. Goparity cannot be held responsible for any errors, omissions, or consequences related to the use of this information.

Go back

Go back