We’ve recently completed scheduled maintenance. If you experience any issues, please clear your cache and refresh the page.

How are the interest rate and monthly payments calculated?

We use the same method used by other financial institutions to calculate the fixed periodic payments.

The periodic payments are determined so that, for a given interest rate, the future periodic payments are equivalent to receiving back the investment today. Goparity uses the 30/360 day-count method, which considers a 30-days month and a 360-days year.

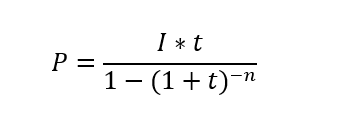

To determine your periodic payment, we use the following formula:

Where:

P = periodic payment

I = amount invested stipulated on the mutual agreement at the time of issuance

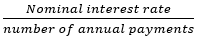

r = periodic interest rate, i.e.,

Nominal interest rate = project’s interest rate

n = total number of payments that include interest and reimbursement of the amount owed

Please note this formula only works if the periodic payment includes interest and part of the reimbursement of the amount owed.

Go back

Go back