We’ve recently completed scheduled maintenance. If you experience any issues, please clear your cache and refresh the page.

How do you measure a project's risk?

Before launching any project, we undertake a rigorous risk assessment to evaluate both the financial and technical viability of the promoter and the project itself. This process includes three key components:

-

Expert Judgement: our credit assessment team evaluates the financial conditions of the project through different financial tools, including an internal credit model that determines a risk rating and an interest rate.

-

Statistical Credit Model: we give the project a quantitative grade on a scale that indicates the promoter’s default probability in the following 12 months. This information is outsourced to an external entity - Wiserfunding - which is accredited by the Bank of Portugal.

-

Policy Criteria: We also assess whether a project or promoter is aligned with United Nations' Sustainable Development Goals (SDGs) and ensure the promoter has no outstanding issues with the Tax Authority, Social Security and Banking System. Promoters must submit formal financial statements for at least one full year and confirm they are not in default or involved in legal disputes.

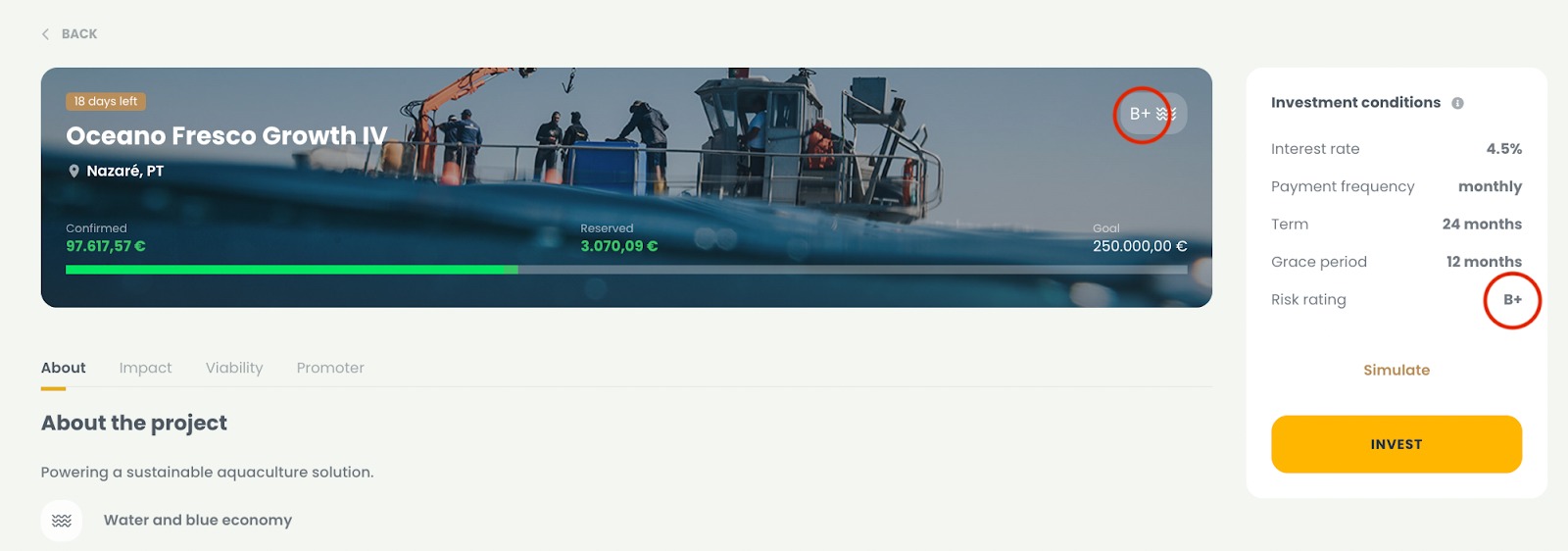

These three steps provide us with a clear perspective on the promoter's financial position, allowing investors to make informed decisions. We assign the project a rating on a scale from "A+" (lowest risk) to D (highest risk). Projects that go through a restructuring process that extends the loan term by more than 12 months are labelled with an "R" rating. This rating is always available on the project's page.

In some cases, we also apply additional risk mitigation measures, such as:

-

Requesting that the promoter pledges the equipment installed as part of the project.

-

Requiring a personal guarantee from one of the company's shareholders.

Go back

Go back