Share

Settled by the promoter

Ecuadorian Cocoa Farming II

Guayas Province, EC

instalment

biannual

term

6 months

yearly interest

4.65%

risk rating

B+

Working capital for family-owned company of small cocoa producers.

Description

The goal of this campaign is to provide working capital to a family-owned company based in the coastal area of the Guayas Province (Ecuador), active in the aggregation, processing, and sale of cocoa products to Europe, North America, and Asia. The Company sources its produce from 2.500 cocoa farmers in the 4 provinces of Los Ríos (the area with the highest production of the world-renown ‘Cacao Nacional’, also named as “Cacao Arriba”), Sucumbios and Orellana (where cocoa produce is differentiated by the area of influence of the Yasuni Biosphere Reserve), and El Oro.

When European traders found Cacao Nacional in the Gulf of Guayaquil, with floral aroma profiles, they asked the merchants where these amazing beans came from. The locals answered “Arriba” – “up-river”, meaning further up the watersheds of the rivers that reach the gulf. The name stuck, and to this day, this cacao is known in Ecuador as “Cacao Arriba”.

The Company is focused on shortening the long supply chains that hinder farmers' market access and on improving their productivity and quality controls through two “capacity-building” programs, which benefit 5.000 families. Its mission is to export the best fine Ecuadorian cocoa beans and their derivatives to the world, promoting fair trade with small producers and traders, while integrating the whole value chain and guaranteeing high-quality standards and responsibility for its human resources and care for the environment.

Overall, Ecuador is the 2nd producer of cocoa in Latin American after Brazil, and for many years, it has been recognized as the largest fine or flavoured cacao producer in the world.

There are two general categories of cocoa beans in the world: “fine or flavour” and “bulk or ordinary”. Fine cocoa production represents less than 5% per year of the world’s cocoa bean production and Ecuador is the largest producer of “fine or flavour” beans, producing over half of the world’s production – the raw material that is required in the European and American industries for fine chocolate production. Evidence from Ecuador suggests that the cocoa premium over the New York Stock Exchange price of fine or flavour cocoa beans is 20% to 30%.

Cocoa production in Ecuador has experienced an overall upward trend in recent years, reaching an estimated 328,000 tons in the crop year 2019/2020, for a value of c. USD700m worth of exports. Production in Ecuador is forecast to continue growing, reaching 340,000 tons in the 2020/21 season.

In Ecuador, approximately 360,000 hectares of cocoa are cultivated by approximately 90,000 farmers. Most of these farmers are relatively poor and operate on less than 10 hectares of land (according to representatives from non-governmental organizations in Ecuador). Their incomes are largely dependent on agricultural production with almost half generated by the sale of cocoa beans. 85% of cocoa production occurs in the coastal plain region of Ecuador.

The funds raised through this campaign will be used as Transactional Working Capital to provide liquidity to the Company from its procurement and processing stage, all the way through its exports. This is the second campaign promoted by Working Capital Associates to provide funding to this company and the sixth to provide funding to small producers from Peru and Ecuador.

The Impact

Direct:

- Better working and financial conditions for small producers, who own less than 10 hectares of land. The Company has established a sustainability program that offers farming communities the following services: technical assistance and training to improve productivity; advice and support to improve the quality of post-harvest; training to develop management, financial, and trading capacities in communities; fair trade practices to improve life quality in the communities.

- Gender quality promotion: the company is fully owned by its female CEO, who runs a senior and experienced team.

Indirect:

- Promotion of an inclusive value chain by joining 5.000 local producers who have access to an international export value chain.

- Contribution to the Company’s social mission, by ensuring cash and premium payments at the “farm gate” to the farmers and early payments at a premium to the Company. The company can then reinvest the money in training, education, social support to the farmers and their families, health support, and help with organic and fair-trade certifications.

- Rural poverty reduction: smallholders will receive a higher profit margin for their produce, which can be allocated to more than pure subsistence. They will also have access to larger national and international markets.

- Contribution to environmental protection: the Ecuatorian focuses on pruning cacao trees and aims to help farmers make the most of what they already have, so they wouldn’t need to press further into the Amazon. Among other sustainable techniques are shade-growing and multi-cropping, as well as the correct use of fertilizer and pesticides, including natural pest control and compost. The goal is to maintain a record of the cocoa until its final delivery to the consumer, guaranteeing traceability on each of its processes from production, postharvest handling, and cocoa distribution.

Impact Indicators

685

people impacted

Contribution to the Sustainable

Development Goals

Sustainable Development Goals

.64a95ce.png)

.4efc673.png)

.39b0412.png)

Financial viability

Transactional Working Capital is a short-term debt financing asset that allows the seller to receive advance/early payments and the buyers to delay their payments. In commercial sales, standard market practice for payments is between 30 to 90 days from the time when the seller issues its invoice – such payment terms usually strain the cash availability of the seller for its own procurement, while allowing the buyer to hold on to their cash for longer. Often, the seller’s working capital gap is resolved by accessing traditional bank financing, which usually requires to be over-collateralized over hard assets (i.e. factories, buildings, machinery). However, due to the elevated requirements demanded by banks as guarantees for the loans, impossible to meet for smallholders, such bank loans seldom resolve any working capital gap.

Transactional Working Capital fills this gap without the need for collateral. That, in turns, obtains the following results for both the smallholders and the aggregator:

- Liquidity to procure raw produce: the aggregator/processor is able to grow its business by increasing the level of raw material procurement to fulfill new orders for its international buyers, without waiting for payment from existing buyers.

- Premium Prices: the producers receive a premium price that reflects the certified and fair trade value of the cocoa, resolving the cash pressure and eliminating the need to provide discounts to the buyer, in return for early payment.

- A higher profit margin that can be reinvested not only to pure subsistence but also in capacity building of technical agricultural skills and technologies, improving production standards, and yield investments in organic, fair trade, and quality certifications.

WCA maintains a Trade Credit Insurance Policy with a global insurance company providing worldwide trade credit insurance, surety, and collections services, with a strategic presence in 50 countries. The Project repayment will be guaranteed under such Trade Credit Insurance Policy, which effectively protects GoParity lenders from default in a credit-related event (e.g. insolvency, bankruptcy). The policy covers losses from Insolvency, Protracted Default, and Political Risk and covers up to 90% of the value of the underlying commercial transaction financed by WCA. As WCA provides up to 80% financing to any underlying commercial transaction, the policy in essence covers more than WCA’s entire financing.

Download Key Investment Information Sheet

The Promoter

About WCA (Working Capital Associates) LLP

WCA is the only female-owned and led company providing direct financing to value chains of agriculture products from Sub Saharan Africa (SSA) and Latin America (Latam).

WCA follows a themed responsible investment approach which “allows investors to address ESG issues by investing in specific solutions to them, such as renewable energy, waste, and water management, sustainable forestry and agriculture, health products and inclusive finance” (PRI).

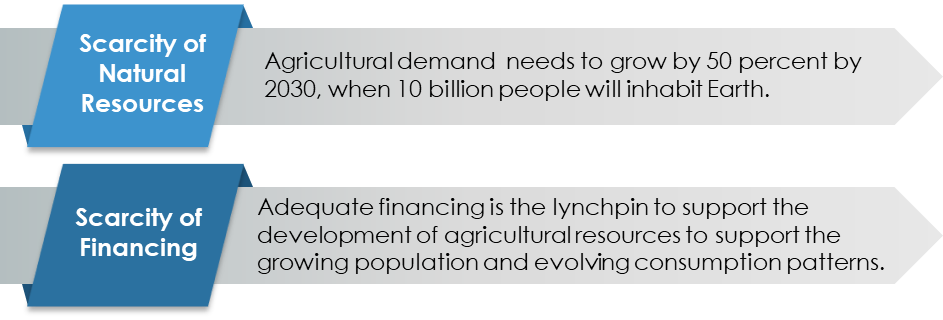

The company follows two key themes:

The company also applies gender-lens to its investments, seeking to finance a significant level of female-led businesses that follow sustainable and responsibly managed standards.

WCA’s goal is to grow value chains by providing access to finance to SMEs, in the framework of three keys SDGs:

- SDG 2 - End hunger, achieve food security, and promote sustainable agriculture.

- SDG 12 - Ensure sustainable consumption and production patterns.

- SDG 8 - Promote inclusive and sustainable economic growth, employment, and decent work for all

The company also applies a “No Harm” Impact Goal, when reviewing its investment opportunities and applying a negative screening to harmful/controversial products and industries.

The team is composed of ten professionals, with senior executive team members having 10+ years of experience in Emerging Markets and/or Trade Finance, and a collective experience in financing over USD1 billion in short-term debt and Emerging Markets transactions.

The team

Business Model

WCA is headquartered in London and registered with the FCA under the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations 2017. The company operates using a “commercial finance company” model, by raising funds (in the form of loans and/or co-investments) from international investors, which it then on-lends to borrowers in their target markets.

The company’s revenue comes from the net interest margin between interest received from the borrowers and interest paid to the lenders.

Traditionally, the funds obtained come from impact funds, credit funds, Development Finance institutions (DFIs), and private wealth seeking thematic investments, which provide the company with medium to long-term funding.

The company’s target market is comprised of 2million SMEs that are financially constrained across Africa (#1.6million) and Latam (#0.4million). Specifically, the company is focusing on Peru, Costa Rica, Colombia, Ecuador, Kenya, Rwanda, Tanzania and Ethiopia, with a preference for food value chains.

The company has tailored its services to SMEs, these suffering from the highest levels of transactional financing requests – approximately 58% of transactional finance proposals are rejected by banks, despite the sector globally submitting 44% of all transactional finance proposals. Banks reject such a high volume of proposals for three specific reasons: very cumbersome AML/KYC requirements imposed by regulators, capital requirements such that short-term financing to lower-rated enterprises is unprofitable and constraints on banks’ capital.

WCA follows the Principles for Responsible Investments based on the Ten Principles of the United Nations Global Compact.

In addition to this, WCA has established ESG standards related to investments in controversial sectors and products. The company believes that certain industries, countries, and/or sectors are not compatible with its principles, and therefore will refrain from financing companies that are against its sustainability values.

Active since

2018

Fiscal country

GB

Operating In

"Latin America and Sub Saharan Africa"

Industry

Investment

Number of Goparity Loans

23

Women Shareholders

Yes

Updates

2022-03-17

Project End

This project has successfully reached its payments plan maturity. All investors have received their full capital invested and interest. Nevertheless, its impact will keep growing for many more years!

2022-01-06

First payment

First instalment was paid to all the investors

2021-07-06

100% funded

454 investors successfully raised 100.000€

2021-06-28

Open for investment

This campaign is open for investment

Sign up to our newsletter and stay up-to-date on our investment opportunities